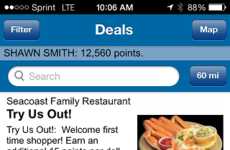

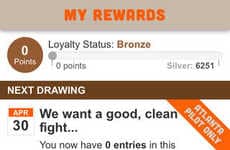

Consumers utilize tools for tracking loyalty rewards to enhance participation

Implications - With more transactions to track than ever before, consumers are opting for digital solutions to keep tabs on loyalty program rewards and financial dealings to maximize efficiency. Streamlining the process, participants ditch traditional measures for interfaces that make access easy and increase the likelihood of participation. This speaks to an increasingly positive reaction to loyalty programs as a whole.

Trend Themes

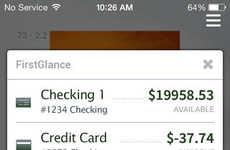

1. Digital Loyalty Cards - Consumers are utilizing digital solutions to keep track of their loyalty program rewards and financial dealings, replacing traditional measures with interfaces that make access easy.

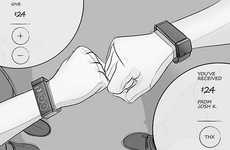

2. All-in-one Credit Cards - All-in-one credit cards are becoming popular as consumers aim to transfer all funds, accounts, credits, and point systems to a single piece of plastic.

3. Smartphone Wallets - Smartphone loyalty card wallets are gaining traction as smartphone apps act like mobile wallets, specifically for all loyalty cards, making the collection of retail reward points easy.

Industry Implications

1. Mobile Technology - Mobile technology has a significant role to play in the trend towards digital loyalty card wallets and smartphone mobile wallets.

2. Fintech - The trend towards all-in-one credit cards is part of the larger fintech revolution in which the financial industry is disrupted by the use of technology.

3. Retail - The loyalty programs trend is clearly relevant to the retail industry, which benefits from increased participation in the loyalty programs through better interfaces for accessing rewards.