TD Bank's Partnership With Moven is Resulting In a Behavior-Changing TD App

Alyson Wyers — June 26, 2015 — Tech

References: tdcanadatrust & theglobeandmail

In an effort to help their customers better track their spending habits, the Toronto-Dominion Bank is partnering up with New York-based app developer Moven on the TD app. Although TD Bank has been offering mobile banking for a while, their collaboration with Moven will allow its users to save more of their money.

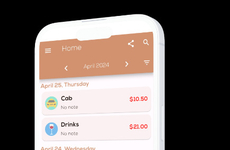

The Moven app functions similar to health trackers, but with a focus on personal finance. Moven enables users to use their smartphones like a mobile wallet and keep track of all purchases at the same time. This helps to analyze the financial health of the app user. So in addition to monitoring spending habits, the app can also influence behavior and incentivize saving.

The updated TD app will offer "soft advice" by giving updates and information about spending habits with every purchase instead of chastising over spending.

The Moven app functions similar to health trackers, but with a focus on personal finance. Moven enables users to use their smartphones like a mobile wallet and keep track of all purchases at the same time. This helps to analyze the financial health of the app user. So in addition to monitoring spending habits, the app can also influence behavior and incentivize saving.

The updated TD app will offer "soft advice" by giving updates and information about spending habits with every purchase instead of chastising over spending.

Trend Themes

1. Personal Finance Apps - The rise of apps like Moven and TD can be indicative of a larger trend towards the use of technology to simplify and personalize personal finance management.

2. Behavioral Finance Tools - The use of personal finance apps to influence consumer behavior is a potential opportunity area for the development of more personalized and effective savings tools.

3. Mobile Banking - The growth of mobile banking apps like TD and Moven signals a trend towards the use of smartphones and other mobile devices as primary banking tools, potentially disrupting traditional banking models.

Industry Implications

1. Banking - The partnership between TD Bank and Moven is an example of how traditional banking institutions are partnering with fintech startups to offer innovative mobile banking services to customers.

2. Fintech - The use of technology to disrupt traditional banking and financial services models, with a focus on personalization, is a key trend for the fintech industry to address.

3. Consumer Technology - The emergence of personal finance apps like Moven and TD is part of a larger trend for the use of technology to simplify and automate daily tasks, potentially disrupting traditional consumer behavior patterns.

3.9

Score

Popularity

Activity

Freshness