Brands educate finance-illiterate consumers with simple services

Implications - Brands help consumers become more financially conscious and confident, by creating educational platforms around the subject. Targeting young consumers (Millennial and Gen Z) who have student debt, loans and a lack of knowledge, brands aim to ease the transition into adulthood with simple educational services. When brands provide this sort of non-traditional assistance, it often acts as a gateway for long-term relationships and solidifies the consumer’s trust.

Workshop Question - What is one way that you can increase your consumers' trust using a similar gateway approach?

Trend Themes

1. Financial Literacy Education - Brands and institutions are creating educational platforms to help consumers become financially conscious.

2. Millennial-focused Finance Education - Companies are developing innovative, entertaining, and digestible resources to educate younger demographics on personal finance.

3. Integrated Payment Solutions for Education - Partnerships between companies are seeking to improve campus commerce systems and the payment experience for students and families.

Industry Implications

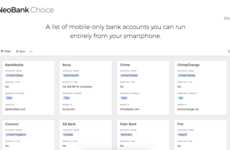

1. Banking & Finance - Institutions and companies are introducing innovative solutions to improve financial literacy and make financial education more accessible.

2. Education - Partnerships between companies are creating better payment systems for educational institutions, while also enabling financial education opportunities for students.

3. Technology - Innovative technological solutions, such as wearables and educational apps, are being leveraged to create better opportunities for financial education.

5 Featured, 43 Examples:

46,206 Total Clicks

Date Range:

Aug 17 — Sep 18

Trending:

Untested

Consumer Insight Topics: