Yahoo Finance is Helping Millennials Save with 'Tanda'

Ellen Smith — February 8, 2018 — Business

References: play.google & psfk

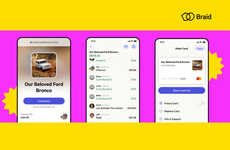

Tanda is a newly launched application from Yahoo Finance that's serving as a new money saving tool for Millennials.

The new social app enables groups of five or nine people to pool their money in an effort to save for short-term financial goals. The tool features a unique rotating monthly payout plan in which each individual contributes a pre-selected amount. At the end of each month, a different individual will take home the culminated amount, until each member had the opportunity to do so.

To ensure complete fairness, Tanda has promised to step in and make a contribution should a friend stop contributing. The over-arching goal of this app is to provide Millennials with a more accessible and interactive means of financial planning.

The new social app enables groups of five or nine people to pool their money in an effort to save for short-term financial goals. The tool features a unique rotating monthly payout plan in which each individual contributes a pre-selected amount. At the end of each month, a different individual will take home the culminated amount, until each member had the opportunity to do so.

To ensure complete fairness, Tanda has promised to step in and make a contribution should a friend stop contributing. The over-arching goal of this app is to provide Millennials with a more accessible and interactive means of financial planning.

Trend Themes

1. Social Saving Apps - Disruptive innovation opportunity: Develop a social saving app that caters to a specific niche demographic, such as single parents or college students.

2. Group Money Saving - Disruptive innovation opportunity: Create a platform that allows larger groups of people to pool their money together for long-term financial goals, such as buying a house or starting a business.

3. Interactive Financial Planning - Disruptive innovation opportunity: Integrate gamification elements into financial planning apps to make the process more engaging and interactive for millennials.

Industry Implications

1. Finance - Disruptive innovation opportunity: Explore partnerships with banks and financial institutions to develop innovative tools and services that cater specifically to millennials.

2. Technology - Disruptive innovation opportunity: Combine virtual reality technology with financial planning apps to create immersive and interactive experiences that help millennials visualize and understand their financial goals better.

3. Social Media - Disruptive innovation opportunity: Leverage social media platforms to create community-driven financial planning apps that encourage millennials to share their savings goals, progress, and tips with each other.

3.4

Score

Popularity

Activity

Freshness