'NeoBank Choice' Helps Users Find the Best Bank for Them

Michael Hemsworth — February 14, 2018 — Tech

References: neobankchoice & betalist

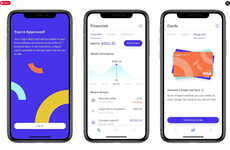

Consumers are no longer satisfied to simply accept services that don't suit their needs or preferences, so new solutions like the 'NeoBank Choice' platform are coming about to help provide access to personalized options.

The platform works by providing users with a list of mobile-only bank accounts that they can run completely from their smartphones rather than having to settle for the brick-and-mortar options out there. This enables users to weigh the pros and cons of each one to find the right option for them rather than settling for something that might not be exactly what they need.

As consumers take a stronger role in their financial planning and accounting, we'll likely continue to see more solutions like 'NeoBank Choice' coming about to put more power in the hands of the user.

The platform works by providing users with a list of mobile-only bank accounts that they can run completely from their smartphones rather than having to settle for the brick-and-mortar options out there. This enables users to weigh the pros and cons of each one to find the right option for them rather than settling for something that might not be exactly what they need.

As consumers take a stronger role in their financial planning and accounting, we'll likely continue to see more solutions like 'NeoBank Choice' coming about to put more power in the hands of the user.

Trend Themes

1. Personalized Banking - The trend of personalization in banking allows users to find the bank that best suits their needs, leading to opportunities for tailored financial products and services.

2. Mobile Banking - The rise of mobile-only bank platforms offers disruptive innovation opportunities in the banking industry by providing convenient, smartphone-based financial services.

3. User Empowerment - Solutions like 'NeoBank Choice' reflect the trend of users taking a stronger role in their financial planning, highlighting opportunities for technologies and tools that empower individuals in managing their finances.

Industry Implications

1. Banking - The banking industry can leverage mobile-only platforms to provide personalized and convenient banking experiences, creating a competitive advantage.

2. Financial Technology (fintech) - The FinTech industry can capitalize on the trend of personalized banking by developing innovative mobile banking solutions that cater to individual preferences and needs.

3. Consumer Finance - The trend of user empowerment in finance opens up opportunities for disruptive innovation in the consumer finance industry, allowing for tailored financial products and services.

1.3

Score

Popularity

Activity

Freshness