Path to purchase is simplified through credit-connected loyalty cards

Implications - Consumers are often looking for speed and convenience when it comes to their regular buying habits and therefore, are more likely to utilize a loyalty card that doesn’t involve too many steps. Some brands, particularly in industries where consumers make frequent purchases, are starting to offer straight-through loyalty cards that don’t ever need to be topped off after initial setup. By removing one extra step in the consumer’s path to purchase, these brands are encouraging increased loyalty with consumers and improving overall in-store experience.

Workshop Question - In what areas can you further streamline your consumer's path to purchase?

Trend Themes

1. Straight-through Loyalty Cards - Simplifying the process for customers to join loyalty programs increases brand loyalty and overall in-store experience.

2. Mobile Payment and Rewards Apps - Consumers can now access loyalty programs and pay for products through mobile devices, creating a faster and more efficient checkout process.

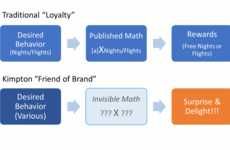

3. Immersive Customer Experiences - Creating unique and unforgettable experiences, such as 'Priceless' culinary experiences, can help businesses increase customer loyalty while standing out from competitors.

Industry Implications

1. Food and Beverage - Food and beverage companies can utilize straight-through loyalty cards, as well as mobile payment and rewards apps, to increase customer loyalty and improve in-store experience.

2. Financial Services - Credit card companies, banks, and insurance providers can develop and offer personalized loyalty programs to create stronger relationships with their customers.

3. Retail - Retailers can benefit from creating immersive customer experiences, such as personalized shopping experiences or unique in-store events, to increase customer loyalty and attract new customers.