Nubank Offers an Alternative to Banking at Large Institutions

Mishal Omar — January 6, 2018 — Business

References: nubank.br

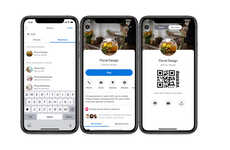

Nubank aims to simplify the process of banking, and is a Brazilian startup that is looking to compete with the five major banking institutions in the country.

Smaller banking institutions are becoming increasingly popular due to new tech innovations in the industry, their accessibility, and the fact that larger institutions tend to be perceived as less trustworthy. Nubank is taking advantage of shifting consumer perceptions by offering a no-free credit cards to Brazilians, opting out of the excessive fees that larger banks in the country enforce. The brand also offers reward points for every dollar spent, which can be used to erase invoice expenses and to pay off purchases that users make regularly.

The startup's site can claims that with regular use, the points collected over a year could pay off a night in Rio de Janeiro for two people, or two Uber trips along with three months of music streaming, and three purchases off Amazon.

Smaller banking institutions are becoming increasingly popular due to new tech innovations in the industry, their accessibility, and the fact that larger institutions tend to be perceived as less trustworthy. Nubank is taking advantage of shifting consumer perceptions by offering a no-free credit cards to Brazilians, opting out of the excessive fees that larger banks in the country enforce. The brand also offers reward points for every dollar spent, which can be used to erase invoice expenses and to pay off purchases that users make regularly.

The startup's site can claims that with regular use, the points collected over a year could pay off a night in Rio de Janeiro for two people, or two Uber trips along with three months of music streaming, and three purchases off Amazon.

Trend Themes

1. No-free Credit Cards - Offering no-fee credit cards to consumers is a trend that disrupts traditional banking practices and attracts customers who want to avoid significant fees.

2. Reward Points Programs - Offering reward points for credit card usage is a trend that incentivizes spending and can increase customer loyalty.

3. Digital Banking - Simplifying the banking process through digital platforms is a trend that appeals to customers seeking accessibility and convenience.

Industry Implications

1. Banking - Smaller banking institutions and startups, such as Nubank, are disrupting the traditional banking industry with new tech innovations and accessibility-focused strategies.

2. Financial Technology (fintech) - Digital banking and innovative credit card offerings are disrupting the FinTech industry and attracting consumers who prefer alternative financial services.

3. Retail - Reward points programs, such as those offered by Nubank, create opportunities for retail partnerships and can encourage customer spending in specific stores.

3.8

Score

Popularity

Activity

Freshness