Investing, saving and spending are all gamified to decrease financial stress

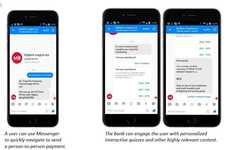

Implications - Finance is becoming increasingly gamified to battle the preconception that money management is mundane. Bringing awareness to individuals who may otherwise prefer to avoid seemingly complex, yet beneficial aspects of finance -- such as investing -- this "fun," streamlined approach shows the importance of demystifying multi-step processes.

Workshop Question - How could your industry gamify the mundane for a more engaged consumer experience?

Trend Themes

1. Gamification of Finance - Increasingly, finance is becoming more gamified as a way to make money management more accessible and less complex.

2. Personalized Mobile Banking Apps - Mobile banking apps are increasingly personalized through the use of real-time technology to meet the needs of millennials and Gen Z.

3. Youth-friendly Payment Systems - With a growing population of digital natives, mobile payment platforms like 'Jassby' are catering to kids, teens, and families to simplify and secure money management.

Industry Implications

1. Fintech - The financial technology industry provides a prime opportunity to innovate and disrupt with gamified finance apps, personalized mobile banking apps, and youth-friendly payment systems.

2. Retail - Retailers can explore strategic partnerships and payment integrations with the aim of personalizing and gamifying the shopping experience.

3. Education - The education industry can use gamified finance apps as a way to teach good financial habits and promote financial literacy in young people.

6 Featured, 50 Examples:

69,021 Total Clicks

Date Range:

May 16 — May 19

Trending:

Average

Consumer Insight Topics: