Finance Coach Penny Uses Easy to Understand Emojis and Graphs

Alyson Wyers — June 16, 2016 — Tech

References: pennyapp.io & springwise

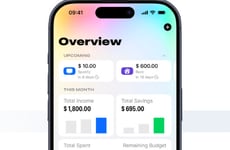

This finance coach for the millennial generation uses easily accessible emojis, graphs and visual content to help young people manage their money. The Penny app lets you track your money, bills, savings and spending habits. The mobile application also employs a chat-based model, further appealing to this smartphone-addicted demographic.

The free money management app sends you "beautifully tailored charts and insights," making budgeting simpler to understand and enabling you to monitor finances and in real time. The personal finance coach categorizes your transactions under four simple headings, allows you to compare monthly reports, offers expenditure break-downs and more. As well, Penny is safe and secure to use, with bank-level security. The comprehensive budget solution has many features banking apps could incorporate into their existing systems.

The free money management app sends you "beautifully tailored charts and insights," making budgeting simpler to understand and enabling you to monitor finances and in real time. The personal finance coach categorizes your transactions under four simple headings, allows you to compare monthly reports, offers expenditure break-downs and more. As well, Penny is safe and secure to use, with bank-level security. The comprehensive budget solution has many features banking apps could incorporate into their existing systems.

Trend Themes

1. Emojis in Finance - Integrating emojis into financial apps can make money management more engaging and user-friendly, especially for the millennial demographic.

2. Graphical Money Tracking - Using visually appealing graphs and charts to visualize personal finances can simplify budgeting and enhance overall financial literacy.

3. Chat-based Financial Coaching - Utilizing a chat-based model for financial coaching can provide a more personalized and interactive experience for users, catering to the smartphone-addicted millennial generation.

Industry Implications

1. Finance Technology - Integration of emojis, graphical representations, and chat-based coaching in financial apps presents disruptive opportunities for fintech startups and traditional finance institutions alike.

2. Personal Finance - Incorporating user-friendly features such as tailored charts, spending breakdowns, and real-time monitoring can create innovative solutions within the personal finance industry.

3. Mobile Banking - By adopting the features offered by apps like Penny, mobile banking institutions can enhance their services and provide a more engaging and user-friendly experience to their customers.

6.5

Score

Popularity

Activity

Freshness