Emirates Islamic Bank's 'El World' Rewards Customers for Transactions

Laura McQuarrie — April 28, 2016 — Tech

References: itunes.apple & emiratesislamic.ae

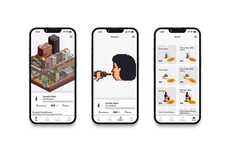

In addition to offering a standard mobile banking app, the Emirates Islamic Bank offers a more entertaining banking app by the name of 'El World.'

Inside El World, banking customers are able to carry out real payments and transactions as usual, but in a gamified universe that allows them to earn points, badges and level up as they complete different actions.

The app is styled to have a friendly and familiar environment that makes the task of banking feel less like a chore. For instance, in order to pay a mobile, cable or Internet bill, the app's users know to go to the living room, where they will be able to find items related to the services.

Inside El World, banking customers are able to carry out real payments and transactions as usual, but in a gamified universe that allows them to earn points, badges and level up as they complete different actions.

The app is styled to have a friendly and familiar environment that makes the task of banking feel less like a chore. For instance, in order to pay a mobile, cable or Internet bill, the app's users know to go to the living room, where they will be able to find items related to the services.

Trend Themes

1. Gamified Banking Apps - Disruptive innovation opportunity: Explore gamification strategies to make banking more engaging and enjoyable for customers.

2. Real-time Transaction Rewards - Disruptive innovation opportunity: Implement rewards systems that incentivize customers to perform transactions through interactive and gamified platforms.

3. Personalized Banking Experiences - Disruptive innovation opportunity: Develop customizable banking apps that cater to individual preferences and create a more personalized user experience.

Industry Implications

1. Banking and Financial Services - Disruptive innovation opportunity: Integrate gamified features into traditional banking services to enhance customer engagement and loyalty.

2. Fintech - Disruptive innovation opportunity: Build innovative banking apps with gamification elements to attract tech-savvy customers and disrupt the traditional banking landscape.

3. Mobile App Development - Disruptive innovation opportunity: Collaborate with banks to create interactive and gamified mobile banking apps that revolutionize the way customers interact with their finances.

4.2

Score

Popularity

Activity

Freshness