Viviplan Creates Unbiased and Affordable Financial Plans

Christopher Martin — November 13, 2017 — Business

References: viviplan

Robo-planning is a new category in the FinTech world that delivers affordable, unbiased financial plans. A series of questions and modules, as well using machine learning technology called 'Optical Character Recognition' are used to take handwritten financial documents and convert them into computer readable text. An API Engine can read the data and translate it into a flawless financial plan that will be sent back to the user in addition to what they share about their situation and goals.

This technology eliminates days of labor that traditional planning requires. Bringing the cost of the service down from anywhere in the $3,000 to $8,000 range to an attainable one-time fee of $700 without sacrificing quality and delivering the plan in a timely matter. To enter all one's documents into the robo-planner takes between one to two hours, as opposed to days of meetings with an in-person Financial Planner. With a robo-planner, users never have to leave their home and can hold the piece of mind that their plans are in their best interests and the process works into their lifestyle.

Viviplan is the first robo-planner of its kind that offers full in-depth, goal-driven financial plans with a promise of never selling any products. Viviplan will provide the user with a financial document that contains a long-term plan for budgeting, estate planning, asset allocation, retirement planning, managing debt and insurance. There is also access to an explanation and an educational session from a certified financial planner over the phone or online when the plan is delivered.

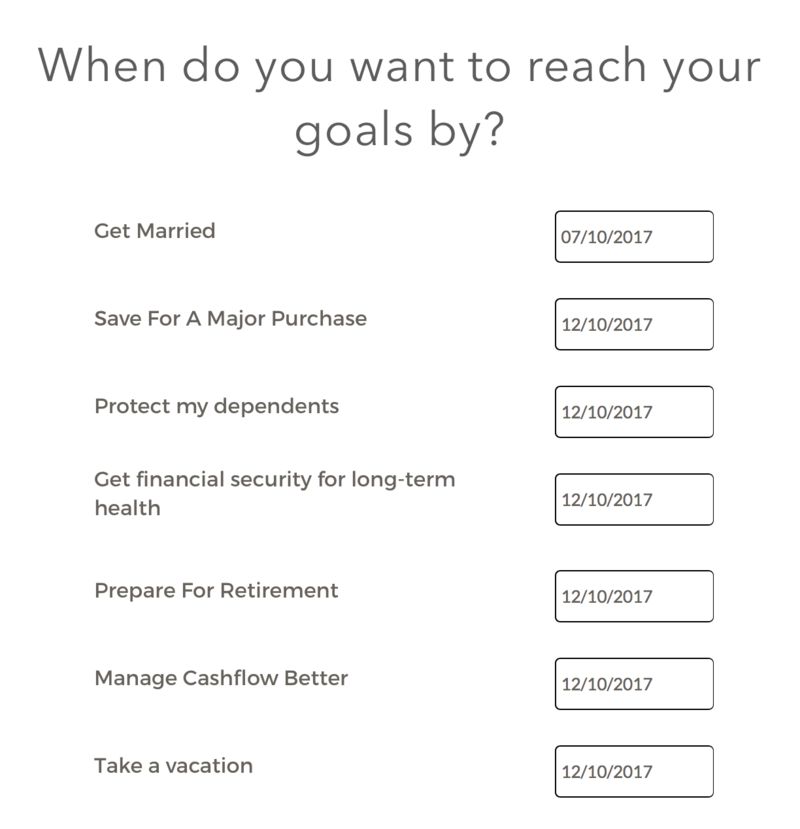

In a time where people are turning to robo-advisors that use AI to manage investment portfolios, there is a need for a similar option, where users have access to unbiased financial plans in a similar platform. A robo-planner like Viviplan is a complement to the users of robo-advisors who want to reach their own financial goals without being pushed investments from an in-person advisor; or anyone uncomfortable with going to their bank. Instead they will use Viviplan to help plan for major purchases or life decisions such as buying a home, retirement, debt or starting a family.

This technology eliminates days of labor that traditional planning requires. Bringing the cost of the service down from anywhere in the $3,000 to $8,000 range to an attainable one-time fee of $700 without sacrificing quality and delivering the plan in a timely matter. To enter all one's documents into the robo-planner takes between one to two hours, as opposed to days of meetings with an in-person Financial Planner. With a robo-planner, users never have to leave their home and can hold the piece of mind that their plans are in their best interests and the process works into their lifestyle.

Viviplan is the first robo-planner of its kind that offers full in-depth, goal-driven financial plans with a promise of never selling any products. Viviplan will provide the user with a financial document that contains a long-term plan for budgeting, estate planning, asset allocation, retirement planning, managing debt and insurance. There is also access to an explanation and an educational session from a certified financial planner over the phone or online when the plan is delivered.

In a time where people are turning to robo-advisors that use AI to manage investment portfolios, there is a need for a similar option, where users have access to unbiased financial plans in a similar platform. A robo-planner like Viviplan is a complement to the users of robo-advisors who want to reach their own financial goals without being pushed investments from an in-person advisor; or anyone uncomfortable with going to their bank. Instead they will use Viviplan to help plan for major purchases or life decisions such as buying a home, retirement, debt or starting a family.

Trend Themes

1. Robo-planning - The rise of robo-planning in the FinTech world provides an opportunity for affordable and unbiased financial planning using machine learning technology.

2. Optical Character Recognition - The use of OCR technology to turn handwritten financial documents into computer readable text provides an opportunity for improved efficiency and cost savings in financial planning.

3. AI-enabled Financial Planning - The need for AI-powered platforms that offer unbiased financial planning is driving the growth of AI-enabled financial planning globally.

Industry Implications

1. Fintech - The development of robo-planners is disrupting the traditional financial planning industry and opening up new opportunities for startups in the FinTech sector.

2. Insurance - Insurtechs can leverage OCR technology to analyze documents and offer personalized insurance plans based on the information gathered, thereby improving the customer experience.

3. Consulting - The growth of AI-enabled platforms offering unbiased financial planning is necessitating a shift in consulting services to incorporate these platforms and provide a holistic approach for businesses and individuals alike.

4.4

Score

Popularity

Activity

Freshness