As microlending becomes more popular, consumers demand services on the go

Implications - Putting a project or product up for open funding by consumers is a mutually beneficial system that particularly suits Millennials for whom community is a priority. Further tailoring to the younger demographic, it seems crowdfunding is becoming more convenient, with apps and tools that allow for on-the-go lending. The convergence of these ideas assists in hyper-targeting this elusive group.

Trend Themes

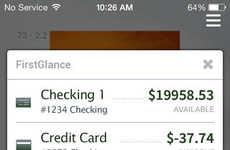

1. Mobile Crowdfunding - Crowdfunding platforms are being optimized for mobile, allowing lending and investing on the go, fueling microlending trends.

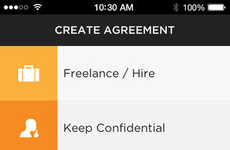

2. Secured Microloan Lending - New ventures offer microloans exclusive to friends and family networks, allowing businesses to be privately supported by their loved ones.

3. Influencer-centric Crowdfunding - Crowdfunding sites aimed at inventors and makers incentivize users to not only fund projects, but also contribute their own ideas, creating an inventor-influencing fundraising community.

Industry Implications

1. Finance - The finance industry can learn from optimized crowdfunding platforms, offering secure mobile options for microloans and investing.

2. Technology - Mobile crowdfunding apps open up a new era of fundraising, encouraging entrepreneurs to create innovative technological advances.

3. Marketing - Crowdfunding platforms aimed at inventors and makers may create a new era of influencer-centric marketing, shaping the public's opinions and demands for innovative products.