Trustleaf Lets Business Owners Borrow From Friends & Family Alone

Rahul Kalvapalle — December 18, 2014 — Business

References: trustleaf

Trustleaf is an innovative microloan-landing service that allows business owners to seek loans from friends and family alone, without having to reveal their campaign to the public.

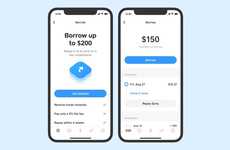

If you're looking to borrow money for a new venture, you start by setting up a campaign on Trustleaf's website and providing pertinent information about your business. Then, select your preferred loan terms. These come with different interest rates, minimum due amounts and an assortment of repayment terms.

Friends and family can then be invited to view the campaign. This system gets rid of the awkwardness that occurs when a friend or family member thinks the deal is unreasonable and wants to haggle but feels too uncomfortable to do so. Once somebody chooses to support your campaign, you essentially already have an agreement in place that both parties are happy with.

If you're looking to borrow money for a new venture, you start by setting up a campaign on Trustleaf's website and providing pertinent information about your business. Then, select your preferred loan terms. These come with different interest rates, minimum due amounts and an assortment of repayment terms.

Friends and family can then be invited to view the campaign. This system gets rid of the awkwardness that occurs when a friend or family member thinks the deal is unreasonable and wants to haggle but feels too uncomfortable to do so. Once somebody chooses to support your campaign, you essentially already have an agreement in place that both parties are happy with.

Trend Themes

1. Microloan Landing Services - Trustleaf's microloan-landing service disrupts traditional borrowing methods by allowing business owners to seek loans from friends and family in a confidential manner.

2. Private Crowdfunding - Trustleaf's platform introduces a private crowdfunding model, enabling business owners to raise funds without making their campaign public, providing an opportunity for disruptive innovation in the crowdfunding industry.

3. Personalized Loan Terms - Trustleaf's offering of different loan terms with varying interest rates and repayment options creates disruptive innovation opportunities in the lending industry by allowing borrowers to customize their loan experience.

Industry Implications

1. Borrowing and Lending - Trustleaf's microloan-landing service has the potential to disrupt the borrowing and lending industry by revolutionizing the way individuals and businesses can obtain loans from their network.

2. Crowdfunding - Trustleaf's private crowdfunding model presents disruptive innovation opportunities in the crowdfunding industry by providing a confidential platform for entrepreneurs to raise funds from friends and family.

3. Financial Technology - Trustleaf's personalized loan terms and confidential microloan services showcase opportunities for disruptive innovation in the financial technology industry by offering innovative solutions for lending and borrowing.

4.3

Score

Popularity

Activity

Freshness