The financial industry adapts to consumer demand for peer-based platforms

Implications - Adjusting quickly to the P2P economy, consumers are increasingly comfortable with leveraging a network of peers for almost everything, including lending and borrowing money. Seeking more personable and seemingly authentic solutions for their financial needs, consumers are open to peer networks that offer more transparency and lower price points that traditional resources.

Workshop Question - What parts of the customer journey could you push on to establish more confidence and trust from consumers?

Trend Themes

1. P2P Insurance - There is a growing trend of P2P insurance services that are becoming popular among consumers who value the cost savings and practicality of shared ownership.

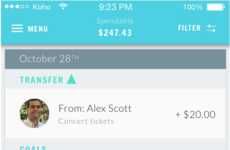

2. Voice Assistant Money Transfers - Voice assisted money transfer services like Google Pay can create a simple and seamless payment experience for consumers in the digital economy.

3. Familial Payment Services - Banks and payment service providers are creating payment solutions that teach children money management skills which could potentially create a loyalty base among their youthful consumers.

Industry Implications

1. Fintech - P2P insurance companies and mobile apps introducing innovative payment systems are examples of trends disrupting the financial services industry.

2. Retail Banking - Bank partnerships with P2P platforms offer an alternative means of providing credit to consumers using a different approach to traditional retail banking.

3. Travel - Currency exchange startups like WeSwap are making foreign exchange cheaper and more efficient for travelers.

7 Featured, 52 Examples:

76,409 Total Clicks

Date Range:

Mar 16 — Apr 18

Trending:

Mild

Consumer Insight Topics: