Buy-now-pay-later platforms gain popularity in purchasing everyday goods

Implications - Where layaway-type payment plans have traditionally been used to buy larger items like home appliances, this model is now being used for online purchases of things such as flights and clothing. For credit-averse Millennials, in particular, this shift means that consumers are able to debit the purchase today and pay for it in installments as funds become available. Solutions like these are especially important as consumption habits change and Millennial consumers continue to engage with brands that align with their core values and lifestyle preferences.

Workshop Question - What is your brand doing to adjust to continued shifts in consumption habits?

Trend Themes

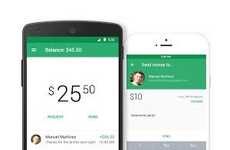

1. Buy-now-pay-later Platforms - Online stores are introducing buy-now-pay-later platforms to attract credit-averse Millennials, offering them flexible payment options and making products more affordable.

2. Instant Checkout Loans - Digital payment services are partnering with banks to offer instant checkout loans, calculating credit scores on the spot and issuing loans based on the customer's score.

3. Installment Payment Services - Travel and clothing companies are offering installment payment services, making expensive goods and services more accessible to consumers and helping them save money over time.

Industry Implications

1. Retail - Retailers are introducing new payment options to attract more customers and make it easier for them to purchase products.

2. Finance - The finance industry is partnering with digital payment services and offering new loan options to customers, making it easier for them to borrow money and make purchases.

3. Travel - Travel companies are offering installment payment services to make it easier for customers to afford travel and save money over time.

5 Featured, 43 Examples:

44,859 Total Clicks

Date Range:

Jun 17 — Jun 18

Trending:

Untested

Consumer Insight Topics: