The New PayPal Bot Lets Users Send Payments Through Slack

References: paypal & digitaltrends

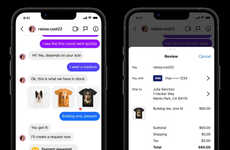

PayPal, the Elon Musk-founded online payment platform, has recently developed a PayPal bot for use inside the Slack chat application. Though PayPal has consistently been on the forefront of technological convenience, the Slack PayPal bot is the company's first foray into the use of chat-integrated systems.

Slack has over five million daily active users, and it has garnered a reputation as one of the best chat platforms for businesses. With such sustained use from professionals, incorporating PayPal into Slack has the potential to make exchanges between team members all the more convenient.

To use the Slack PayPal bot, users just have to activate the bot with the "/PayPal" command. After that, they can ask the bot to send money to another Slack user, and it will do so directly in the app.

Slack has over five million daily active users, and it has garnered a reputation as one of the best chat platforms for businesses. With such sustained use from professionals, incorporating PayPal into Slack has the potential to make exchanges between team members all the more convenient.

To use the Slack PayPal bot, users just have to activate the bot with the "/PayPal" command. After that, they can ask the bot to send money to another Slack user, and it will do so directly in the app.

Trend Themes

1. Chat-based Payment Systems - Incorporating payment functions into chat platforms offers greater convenience for users and opens up new opportunities for payment providers to reach a wider audience.

2. Integration of Personal Finance Management Into Workspace Applications - Integrating personal finance management functions into workspace applications such as Slack allows for greater accessibility and ease of use for users.

3. Expansion of Commerce Within Messaging Systems - The expansion of commerce within messaging systems creates a new channel for businesses to reach users directly within their messaging platforms.

Industry Implications

1. Finance - The finance industry can stay ahead of competition by exploring digital payment options that cater to the needs of today’s fast-paced work environments.

2. Technology - Technology companies can improve and future-proof their products by integrating payment systems into their platforms and software.

3. E-commerce - E-commerce companies can explore the potential of integrating commerce and payments into messaging platforms, thereby providing a more seamless shopping experience for their customers.

0.5

Score

Popularity

Activity

Freshness