ICICI Bank and Paytm are Offering a 'Pay Later' Option via Mobile Wallets

Laura McQuarrie — November 16, 2017 — Lifestyle

References: blog.paytm & bgr.in

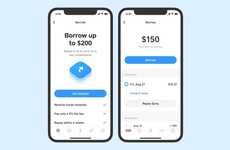

ICICI Bank and Paytm joined forces to launch 'Paytm-ICICI Bank Postpaid,' a new service that makes it possible for customers to take advantage of a "pay later" solution when using the mobile digital wallet.

The new feature exclusively for ICICI Bank customers with a Paytm wallet marks the first time that a large commercial bank is offering loans via a digital payment service. When checking out, consumers have the option to make the most of a "Pay Later" option that will calculate one's credit score on the spot. From there, the size of the loan issued is determined based on the credit score of the customer.

As Paytm founder and CEO Vijay Shekhar Sharma notes: "It’s common for us to ask a trusted friend for money for frequent expenses and promise to pay later. These exchanges are based on trust that you will pay back as soon as you have access to money."

The new feature exclusively for ICICI Bank customers with a Paytm wallet marks the first time that a large commercial bank is offering loans via a digital payment service. When checking out, consumers have the option to make the most of a "Pay Later" option that will calculate one's credit score on the spot. From there, the size of the loan issued is determined based on the credit score of the customer.

As Paytm founder and CEO Vijay Shekhar Sharma notes: "It’s common for us to ask a trusted friend for money for frequent expenses and promise to pay later. These exchanges are based on trust that you will pay back as soon as you have access to money."

Trend Themes

1. Mobile Wallet Loans - Digital payment services are teaming up with commercial banks to offer loans through mobile wallets, presenting an opportunity for disruptive innovation in the lending industry.

2. Pay Later Options - The option of paying later at checkout is becoming increasingly popular, providing opportunities for disruptive innovation in the payment processing industry.

3. Real-time Credit Scoring - The ability to calculate credit scores in real time is disrupting the traditional lending industry and opening new opportunities for innovation in credit services.

Industry Implications

1. Digital Payment Services - Digital payment services are partnering with commercial banks to offer loans, presenting opportunities for disruptive innovation in the payment processing industry.

2. Fintech - The lending and payment processing industries are ripe for innovation as the rise of fintech companies challenges traditional models.

3. Retail - The retail industry can benefit from the option of providing customers with instant loans at checkout, increasing sales and customer loyalty.

0.4

Score

Popularity

Activity

Freshness