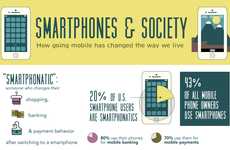

As apps make banking more accessible, budgeting comes to the forefront

Implications - With banking apps becoming popularized, consumers are armed with more information about their financial standing than ever before. This automated and convenient approach to banking lends nicely to the budget-conscious consumer, who can use these apps to set goals and track spending easily.

Trend Themes

1. Mobile Budgeting - Consumers are increasingly relying on budgeting apps, tools and platforms for streamlining their finances.

2. Personalized Finance Management - Smartphone apps are becoming essential tools to personalize financial management for individual consumers.

3. Guided Buying Decisions - Budgeting apps are starting to offer suggestions and help consumers make informed buying decisions.

Industry Implications

1. Fintech - Mobile budgeting apps and tools are quickly becoming the norm for budget-conscious consumers.

2. Retail - Retailers can benefit from the trend of guided buying decisions by partnering with budgeting platforms to recommend products in specific price ranges.

3. Education - Educational institutions can help the younger generation learn about budgeting and personal finance by incorporating mobile apps into their curricula.