Budget Your Money with the Level Money App

Jennifer Paul — January 19, 2014 — Tech

References: levelmoney & techcrunch

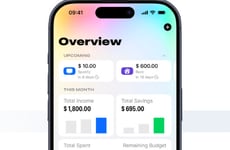

If budgeting is something that you struggle with, the level money app can help you adjust your lifestyle to spend less and save more. The app bills itself as a "real-time money meter" because of its visual data that displays your spending. At a glance, you are able to see how much money you have left over to spend and still stay within your personal budget.

It also creates a recommended financial plan that can include recurring payments that you need to make. The app is connected to 70 U.S. banks and it can cover over 85% of accounts in the entire country. The Level Money app automatically updates your spending as you make your purchases each day and provides simple and clear pictures of how you're keeping on track.

It also creates a recommended financial plan that can include recurring payments that you need to make. The app is connected to 70 U.S. banks and it can cover over 85% of accounts in the entire country. The Level Money app automatically updates your spending as you make your purchases each day and provides simple and clear pictures of how you're keeping on track.

Trend Themes

1. Real-time Spending Monitoring - Disruptive innovation opportunity: Develop an app that provides real-time tracking and analysis of personal spending to help users make informed financial decisions.

2. Automated Budgeting Tools - Disruptive innovation opportunity: Create a platform that automatically generates personalized budget plans based on users' financial data to simplify and optimize their spending habits.

3. Connected Banking Solutions - Disruptive innovation opportunity: Integrate multiple financial institutions into a comprehensive banking app that allows users to manage all their accounts in one place and track their spending across different banks.

Industry Implications

1. Personal Finance Apps - Disruptive innovation opportunity: Develop a personal finance app with features that go beyond budgeting tools, such as investment tracking, debt management, and personalized financial insights.

2. Financial Technology (fintech) - Disruptive innovation opportunity: Create innovative financial technology solutions that leverage advanced analytics and AI to empower individuals to make smarter financial decisions.

3. Banking and Financial Services - Disruptive innovation opportunity: Partner with banks and financial institutions to develop new solutions that enhance the user experience, reduce friction in financial transactions, and increase financial literacy.

2.3

Score

Popularity

Activity

Freshness