Consumers turn to automated forms of money management to curb stress

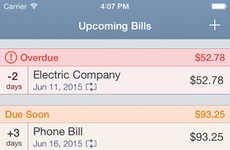

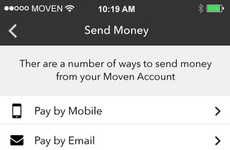

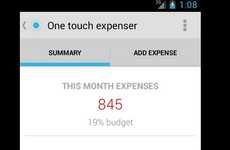

Implications - Though people are becoming more conscious and independent with their money, they continue to find financial management stressful and time-consuming. As a result, devices and apps that include automation have emerged onto the market. The ability to automate routine financial tasks points towards the growing trend of convenience, as well as technology as the streamlining solution.

Workshop Question - How can you leverage automation to help make it easier for customers to connect with your brand?

Trend Themes

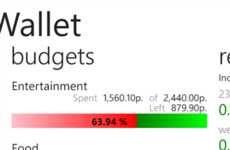

1. Automated Financial Management - The trend of automation in routine financial tasks points to growing demand of convenience and technology as the streamlining solution.

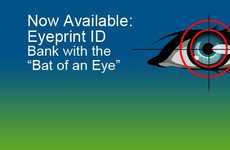

2. Biometric Authentication Systems - Authentication systems that only require swipe or finger-sliding pattern remove the need for typing passwords or personal security questions.

3. AI-assisted Financial Advice - Financial advice platforms that utilize AI enable personalized management of money matters with voice-activated programs and smartphone-compatible apps.

Industry Implications

1. Finance - The finance industry could leverage automation, biometric systems, and AI-assisted advice platforms to improve customer experience, reduce operational costs, and optimize financial planning and management.

2. Technology - The technology industry could develop and market innovative solutions in the areas of automation, biometric systems, and AI-assisted advice platforms to cater to the growing demand for convenience and optimize workflow efficiency across different sectors.

3. Education - The education industry could utilize AI-assisted platforms like NextGenVest's College Money Mentor to improve financial literacy among students, offer personalized financial advice, and prevent student debt and dropout rates.