Brands are launching initiatives to support startups amid COVID

Trend - Brands in various sectors ranging from finance to technology are aiming to support new businesses developing during and post-COVID. These initiatives include banking tools, credit cards, and technological support.

Insight - North American economies have taken a substantial hit in light of the ongoing pandemic and new businesses are lacking the financial support necessary to be successful in the uncertain commercial landscape. This is in part due to a lack of consumer demand, as shoppers shift their spending to more essential items like food and clothing and less on luxuries like travel or dining. Brands with a B2B focus are supporting these businesses as they understand it will serve them better in the long-term to have loyal customers, especially in a time when the economy remains uncertain.

Insight - North American economies have taken a substantial hit in light of the ongoing pandemic and new businesses are lacking the financial support necessary to be successful in the uncertain commercial landscape. This is in part due to a lack of consumer demand, as shoppers shift their spending to more essential items like food and clothing and less on luxuries like travel or dining. Brands with a B2B focus are supporting these businesses as they understand it will serve them better in the long-term to have loyal customers, especially in a time when the economy remains uncertain.

Workshop Question - How can your brand serve struggling consumers post-COVID?

Trend Themes

1. Startup Support Initiatives - Brands in various sectors are aiming to support new business development during and post-COVID through tools such as banking, credit cards, and technological support.

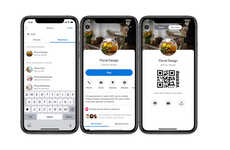

2. E-commerce COVID-19 Support - Yo!Kart is launching COVID-19 support initiatives to help small and medium-sized businesses transition to online sales through offers, discounts, and e-commerce solutions.

3. Pandemic Relief Banking - Starling Bank launched a new digital banking Toolkit and a US dollar account to aid British entrepreneurs with small or medium-sized businesses with managing their finances as economies start to reopen post-COVID.

Industry Implications

1. Fintech Industry - The pandemic relief banking trend creates an opportunity for the FinTech industry to provide innovative solutions for entrepreneurs who cannot access traditional banking, including small and medium enterprises (SMEs).

2. Delivery Services Industry - Virtual restaurant startups such as Virturant are creating opportunities for the delivery services industry by providing restaurant with spare capacity to produce virtual brands that can be discovered on delivery app platforms.

3. Start-up Mentoring Industry - Startup support initiatives from various brands offer opportunities for the startup mentoring industry to provide assistance and guidance to new businesses navigating the uncertain commercial landscape during and post-COVID.