Millennials and Gen Z use different platforms to balance their various jobs

Implications - With Millennials being much more likely to have multiple jobs than the generations that precede them, they're turning to a variety of resources that help them organize their work, schedules, and money. This shift is not simply a result of financial need, but of the oft-unrecognized entrepreneurial tenacity of this generation, with brands meeting them halfway by helping them curate the experiences they'd like in their professional lives.

Workshop Question - How could your brand create more seamless experiences to ease the life of its consumers?

Trend Themes

1. Gig Economy Management Platforms - The rise of freelancing and gig work among millennials and Gen Z is driving demand for platforms like Flowmagic that manage projects and payments for remote workers.

2. Automated Savings Platforms - Financial technology platforms like Revolut Vaults appeal to millennials who have a desire to save for the future but need simple and automated solutions that work with their daily spending habits.

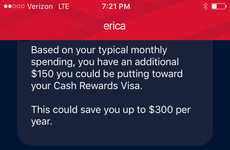

3. AI-powered Financial Assistants - The use of AI-powered virtual financial assistants, such as Bank of America's Erica, is on the rise as millennials and Gen Z seek out personalized and automated ways to manage their finances.

4. Skills-based Team Management - Competency-focused platforms like Project Pad reflect millennials' desire for horizontal and flexible career paths and offer companies a more effective way to match employees with projects based on their skills and interests.

5. Entry-level Job Boards - Platforms like EntryLevels.co are becoming popular with millennials who seek entry-level opportunities that match their skill sets and work with their lifestyle preferences such as part-time and freelance work.

Industry Implications

1. Freelancing and Gig Work Management Platforms - Freelancing and gig work is becoming increasingly popular as new platforms become available to match remote workers with companies and manage projects and payments.

2. Personal Finance and Savings Technology - The growing demand for automated savings, financial management and personalized investment solutions is driving innovation in the fintech industry.

3. Artificial Intelligence and Machine Learning in Financial Services - AI-powered personal finance advisors and virtual assistants are becoming common sights in the banking industry, offering customers personalized support and automated financial advice.

4. Professional Development and Skills-based Matchmaking Platforms - The use of skills-based employee management and project matchmaking platforms is on the rise, as companies seek out more efficient and effective ways to match employees with projects based on their interests and skill sets.

5. Job Boards and Career Development Platforms - As millennials and Gen Z continue to build careers based on flexibility, remote work and horizontal career paths, the demand for specialized job boards and career development platforms is growing.