Apps use micro payments to invest and pay down debts

Implications - Brands are offering financial apps that allow users to invest, save or reduce debts with small sums of money. This shift comes as consumer debt in the U.S. remains higher than it has ever been, and the majority of Americans fear stock markets–in part due to past experiences with financial crises, and a lack of education in the subject. The use of micro investment, debt reduction and saving apps resolves the intimidating nature of growing financial portfolios by removing reluctance-evoking barriers, including high risks and steadfast commitment.

Workshop Question - How can your business reduce some of the barriers associated with customers committing to its brand?

Trend Themes

1. Micro-investment - The availability of financial apps that allow users to invest, save or reduce debts with small sums of money.

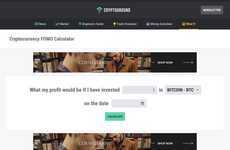

2. Spare-change Investment Platforms - New platforms utilizing spare change from everyday purchases to invest in cryptocurrencies.

3. Automated Investment Solutions - Platforms that enable automatic and noninvasive micro investment for those who can't afford to invest large sums.

Industry Implications

1. Finance Industry - Innovative financial apps are changing the way people save, invest, and reduce debt.

2. Cryptocurrency Industry - New platforms are enabling more people to invest in cryptocurrencies and turn spare change into valuable investments.

3. Fintech Industry - Innovative fintech solutions are providing simpler and more accessible financial options to consumers.