The ChangEd App Uses Spare Change to Pay Off Student Loans

Michael Hines — August 27, 2017 — Lifestyle

References: itunes.apple & gochanged

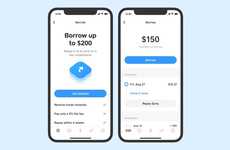

The ChangEd app is designed to help people pay off student loans using their spare change. The spare change is collected by rounding up purchases. Users link their bank accounts to the app and every time a transaction is recorded the app rounds it up to the nearest dollar; even dollar transactions are rounded up an extra buck. When a user hits $100 in spare change roundups the ChangEd app sends a payment to their student loan servicer.

The ChangEd app features a dashboard that lets users know how much they're saving, both in interest costs and with regard to how many years they're cutting off the life of their loan. The ChangEd app is currently only available for iOS but an Android version is in the works.

The ChangEd app features a dashboard that lets users know how much they're saving, both in interest costs and with regard to how many years they're cutting off the life of their loan. The ChangEd app is currently only available for iOS but an Android version is in the works.

Trend Themes

1. Spare Change-saving Apps - Opportunity for app developers to create similar platforms that help users save money by rounding up purchases and applying the spare change to debt repayment or savings goals.

2. Loan Repayment Platforms - Disruptive innovation opportunities exist for companies that create platforms to facilitate the repayment of various types of loans using spare change or micro-payments.

3. Mobile Financial Applications - With the success of apps like ChangEd, there is potential for more mobile financial applications that empower users to optimize their finances and achieve their financial goals.

Industry Implications

1. Financial Technology - Companies in the fintech industry can explore ways to integrate spare change-saving features into their existing products or develop new solutions for debt repayment and saving.

2. Student Loan Servicing - Opportunity for student loan servicing companies to partner with spare change-saving apps to streamline loan repayment and offer additional benefits to borrowers.

3. Mobile App Development - App developers can capitalize on the trend of spare change-saving apps by creating similar platforms or expanding the functionality of existing mobile financial applications.

1.4

Score

Popularity

Activity

Freshness