The 'Deb' Platform Helps Users Manage Debt to Alleviate Stress

Michael Hemsworth — April 24, 2017 — Lifestyle

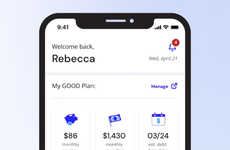

Debt collectors are notorious for being aggressive when calling the person who owes money, so the 'Deb' platform is intended to help consumers manage debt in a stress-free way.

'Deb' is a web and mobile platform that allows consumers to communicate with collectors to manage the collection amount by validating, negotiating or paying off the money that's due. This eliminates the need for collectors to aggressively call the person requesting payment to ensure that everyone is on the same page.

It can be difficult to manage debt from a consumer perspective given the few ways to keep up with information regarding how much is due and the like. The 'Deb' platform works to ensure that consumers are always on top of their bills.

'Deb' is a web and mobile platform that allows consumers to communicate with collectors to manage the collection amount by validating, negotiating or paying off the money that's due. This eliminates the need for collectors to aggressively call the person requesting payment to ensure that everyone is on the same page.

It can be difficult to manage debt from a consumer perspective given the few ways to keep up with information regarding how much is due and the like. The 'Deb' platform works to ensure that consumers are always on top of their bills.

Trend Themes

1. Debt Management Platforms - Opportunity for disruptive innovation in providing platforms that help consumers manage debt and communicate with collectors.

2. Stress-free Debt Management - Opportunity for disruptive innovation in developing stress-free platforms for consumers to manage and communicate about their debt.

3. Enhanced Consumer Debt Communication - Opportunity for disruptive innovation in creating platforms that enable smooth communication between consumers and debt collectors.

Industry Implications

1. Fintech - Opportunity for disruptive innovation in the financial technology sector to develop innovative debt management platforms.

2. Consumer Services - Opportunity for disruptive innovation in consumer services sector by providing stress-free debt management solutions.

3. Communication Technology - Opportunity for disruptive innovation in communication technology sector to improve communication between consumers and debt collectors.

0.6

Score

Popularity

Activity

Freshness