Monetary tracking allows consumers to track funds in an efficient manner

Implications - In a post-recession era, consumers are more paranoid about their funds than ever, turning to high-tech devices to make finances easier to track. Online charts and spending apps cater to individuals who may not be well-versed in the realm of money management, yet are looking for ways to record their monetary habits. This creates a level playing field in the world of money management, while satiating a consumer need to feel in control.

Trend Themes

1. Virtual Banking Platforms - The rise of virtual banking platforms such as GoBank that eliminate the need for physical bank branches creates an opportunity for disruptive innovation focused on creating more accessible and user-friendly online banking experiences.

2. Digital Loyalty Cards - The trend of scannable rewards card apps like Stocard opens up opportunities for companies to streamline their rewards programs, while also providing users with a simpler way of managing their reward points.

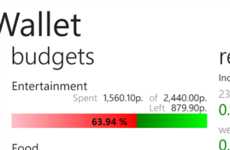

3. Real-time Budget Trackers - The trend of personal spending monitoring apps such as Level Money and Money Wallet creates an opportunity for disruptive innovation focused on simplifying the process of budgeting, tracking and monitoring personal finances.

Industry Implications

1. Banking - The virtual banking trend highlights disruptive opportunities for companies to revamp the traditional banking experience and create more accessible and user-friendly online banking experiences.

2. Retail - The digital loyalty card trend highlights opportunities for retailers to streamline their rewards programs, while also providing users with a simpler way of managing their reward points, driving customer engagement and loyalty.

3. Personal Finance - The real-time budget trackers trend highlights opportunities for companies to simplify the process of budgeting, tracking and monitoring personal finances and optimizing user experience through seamless integration with other useful financial tools.