Insurance systems become more data-driven and transparent

Implications - Insurance plans are becoming more customized according to factors such as ability and effort, thanks to tracking systems that collect personal data. Consumers are willing to forego privacy if it means a pricing model based on merit, rather than seemingly arbitrary characteristics. Data collection has ultimately enabled brands to be impartial and equitable, factors which are highly valued by consumers.

Workshop Question - How well does your brand customize its offerings based on consumer information? If that were your number one focus, how would that change your strategy?

Trend Themes

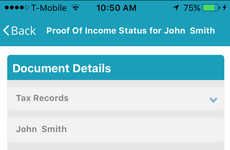

1. Data-driven Insurance - Customized insurance plans that are tailored to personal data and tracked through wearables and mobile apps are creating a fair and equitable insurance landscape.

2. Biometric and Behavioral Insurance - Tracking biometric data and driver behavior can lead to customized insurance rates and incentives for safer driving habits.

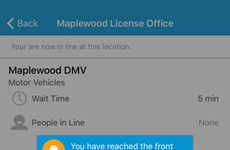

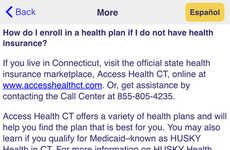

3. Insurance Comparisons and Managing Platforms - Innovative healthcare management platforms and insurance comparison apps make it easier for consumers to shop around for the best rates and manage their insurance plans.

Industry Implications

1. Insurance Technology (insurtech) - The insurtech industry is focused on disrupting the traditional insurance space by offering creative and innovative uses of data for customized insurance plans that cater to the needs of modern consumers.

2. Automotive Industry - The automotive industry is being increasingly influenced by data-driven solutions, from tracking driver behavior to creating customized insurance plans that are based on driving history.

3. Healthcare Industry - The healthcare industry is being transformed by innovative platforms that make it easier to manage health plans and offer customized insurance plans for individuals.

9 Featured, 67 Examples:

237,991 Total Clicks

Date Range:

Jul 14 — Nov 16

Trending:

Mild

Consumer Insight Topics: