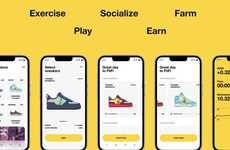

Alfa-Bank Promotes Health and Wealth with its Fitness Banking System

Megan Facciuolo — May 27, 2014 — Lifestyle

References: alfabank & designtaxi

A bank in Russia called Alfa-Bank is giving its customers a reason to stay fit through a fitness banking system called Alpha Activity. Using fitness trackers, like RunKeeper and Fitbit, the system is essentially an online platform that monitors customers’ movements. Depending on how much movement is made each day, small amounts of money is transferred into the user's special savings account.

It is averaged that people need to makes at least 10,000 steps a day in order to remain healthy, but unfortunately due to the work-oriented lifestyle modern society leads, fitness falls to the bottom of people's priority lists. Alfa-Bank wanted to show its customers that it cares for their quality of life by providing the financial incentive. According to the company, its clients using the system save twice as much as those who are not.

It is averaged that people need to makes at least 10,000 steps a day in order to remain healthy, but unfortunately due to the work-oriented lifestyle modern society leads, fitness falls to the bottom of people's priority lists. Alfa-Bank wanted to show its customers that it cares for their quality of life by providing the financial incentive. According to the company, its clients using the system save twice as much as those who are not.

Trend Themes

1. Fitness Banking - Other banks and fintechs could develop similar fitness banking systems, promoting health and wealth simultaneously.

2. Personalized Savings - Using data from fitness trackers, banks could personalize savings plans for customers based on their physical activity level.

3. Wellness Incentives - Beyond fitness, other industries could offer wellness incentives such as discounts or other rewards for healthy behaviors.

Industry Implications

1. Banking - Banks could innovate by incorporating fitness and wellness incentives into their offerings to attract and retain customers.

2. Fintech - Fitness banking systems could be developed by fintech startups as a disruptive innovation in the financial industry.

3. Health and Fitness - Gyms, fitness studios and other health and wellness businesses could partner with financial institutions to create wellness incentives that appeal to customers beyond traditional gym memberships.

4.8

Score

Popularity

Activity

Freshness