Virtual advisors manage customer assets using algorithms

Implications - Colloquially referred to as "robo-advisors", virtual advisors offer a cost-efficient alternative to investors that's more affordable than their human counterparts. Combining convenience with accessibility, such services use complex algorithms to manage a customer's investments rather than human opinion. This progression speaks to the need for varied levels of access in the finance sector and the willingness on the part of consumers to entrust large financial decisions to automated means.

Workshop Question - How could your brand adopt automation to make consumers' lives easier?

Trend Themes

1. Robo-advisors - The rise of robo-advisors in the finance industry creates opportunities for cost-efficient investment management solutions.

2. Artificial Intelligence in Personal Finance - The integration of AI technology in personal finance offers personalized solutions to individuals who may not have considered financial services before.

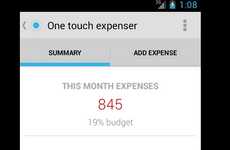

3. Voice-activated Finance Apps - Voice-activated finance apps provide an innovative solution to managing finances through technology, making it easier for users to keep track of their spending.

Industry Implications

1. Finance - The finance industry can leverage robo-advisors and AI technology to create innovative investment management solutions.

2. Technology - The integration of AI, voice-activated commands, and mobile applications creates opportunities for tech companies to develop innovative personal finance solutions.

3. Education - The rise of personal finance apps and AI-powered solutions creates an opportunity for educational institutions to teach financial literacy in a more accessible and interactive way.