The Free 'Mint App' Helps Keep Track of Finances to Plan for Retirement

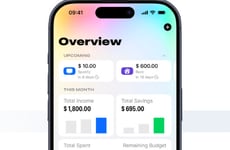

The Mint app features a personalized design that allows users to track funds, keep up-to-date with bills and plan a retirement fund. This app is free to download and it can be easily customized to suit each users different lifestyle needs.

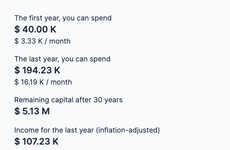

One key feature of the app is its unique ability to help users plan ahead and create a retirement saving plan. By constantly keeping track of spending, income and bills, this handy app will notify users when they are spending too much.

The all-in-one Mint app ensures that future retirement goals can be set, maintained and reached based on each persons specific financial situations. All finances can be stored in one easy place so the user can create budgets for today that will allow for future success. The app provides tips and advice that will save money and allow each user to reach their retirement goals.

One key feature of the app is its unique ability to help users plan ahead and create a retirement saving plan. By constantly keeping track of spending, income and bills, this handy app will notify users when they are spending too much.

The all-in-one Mint app ensures that future retirement goals can be set, maintained and reached based on each persons specific financial situations. All finances can be stored in one easy place so the user can create budgets for today that will allow for future success. The app provides tips and advice that will save money and allow each user to reach their retirement goals.

Trend Themes

1. Personalized Retirement Planning - The Mint app provides personalized retirement planning by tracking funds, bills, and creating customized retirement saving plans based on each user's financial situation.

2. Financial Tracking and Notifications - The Mint app helps users track spending, income, and bills, and notifies them when they are spending too much, enabling better financial management for retirement planning.

3. All-in-one Finance Management - The Mint app allows users to store all their finances in one place, create budgets, and receive tips and advice, making it a convenient tool for reaching retirement goals.

Industry Implications

1. Financial Technology (fintech) - The Mint app belongs to the FinTech industry by combining technology and finance to provide personalized retirement planning and financial management solutions.

2. Mobile App Development - The development of retirement planning apps like Mint presents opportunities in the mobile app industry, meeting the increasing demand for financial tools and convenience.

3. Retirement Planning and Financial Services - The Mint app disrupts the retirement planning and financial services industry by offering an all-in-one solution that simplifies financial management and helps users reach their retirement goals.

1.4

Score

Popularity

Activity

Freshness