The 'Sensibill' App Takes the Stress Out of Doing Taxes

Christopher Magsambol — August 12, 2015 — Business

References: getsensibill & theglobeandmail

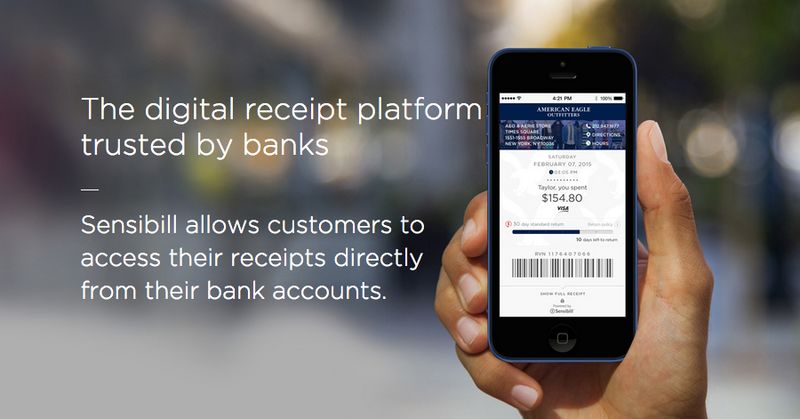

Doing taxes just got easier with a new app called 'Sensibill'. The app eliminates the annoying process of collecting every receipt, allowing users to take a picture of each receipt which will then be stored in the app.

Sensibill is also capable of connecting to a bank's online platform, which makes doing taxes a much easier process. Sensibill is slated be ready for the 2016 tax season and has already partnered with many Canadian banks. Sensibill is also in the process of connecting with many banks in the US and Britain. Sensibill also has many convenient capabilities including matching receipts to transaction statements eliminating the need for calling, chargebacks and unnecessary investigations.

Banks also hope that Sensibill will draw more customers to use online banking tools as well, rather than seeking out independent financial advisers.

Sensibill is also capable of connecting to a bank's online platform, which makes doing taxes a much easier process. Sensibill is slated be ready for the 2016 tax season and has already partnered with many Canadian banks. Sensibill is also in the process of connecting with many banks in the US and Britain. Sensibill also has many convenient capabilities including matching receipts to transaction statements eliminating the need for calling, chargebacks and unnecessary investigations.

Banks also hope that Sensibill will draw more customers to use online banking tools as well, rather than seeking out independent financial advisers.

Trend Themes

1. Simplified-tax-apps - Opportunity for disruptive innovation: Develop a simplified tax app that integrates with multiple banks' online platforms to streamline the tax filing process.

2. Receipt-management-technology - Opportunity for disruptive innovation: Create a receipt management technology that uses image recognition and matches receipts to transaction statements, reducing the need for manual data entry.

3. Digital-banking-enhancements - Opportunity for disruptive innovation: Enhance online banking tools to include features like receipt storage and tax filing functionalities, attracting more customers and reducing reliance on independent financial advisers.

Industry Implications

1. Fintech - Opportunity for disruptive innovation: Develop fintech applications that optimize tax filing and receipt management processes for individuals and businesses.

2. Banking - Opportunity for disruptive innovation: Implement digital banking enhancements that offer integrated receipt management and tax filing features, improving customer experience and engagement.

3. Accounting - Opportunity for disruptive innovation: Explore partnerships with simplified tax app developers to provide accounting software integrations, automating data transfer and streamlining tax preparation.

1.7

Score

Popularity

Activity

Freshness