Charities take a backseat to doing social good through microloans

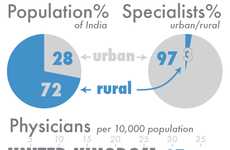

Implications - It only takes a small amount of money from individuals part of a much larger collective to have a big impact on the world. The most appealing aspect to micro-lending to the public isn't just that it's low risk (the large majority of loans are paid back), but the more personal & communal aspect of micro-lending.

Trend Themes

1. Microcredit From High Net Worth Individuals - High net worth individuals are starting to lend their assets to microfinance companies, providing a new source of capital and an ethical way to use their assets.

2. Crowdfunding for Loans - Crowdfunding websites dedicated to loans are emerging and providing individuals with an alternative to traditional institutions while also creating opportunities for new funding sources.

3. People-focused Finance - Financial institutions are emerging with a triple bottom line philosophy that focuses on investing in people, the environment, and the arts and culture.

Industry Implications

1. Microfinance Industry - Microfinance companies can develop partnerships with high net worth individuals to provide an ethical source of capital or utilize crowdfunding platforms to access new sources of funding.

2. Peer-to-peer Lending Industry - Crowdfunding websites offer new opportunities for individuals to obtain loans, disrupting traditional lending models and creating innovative funding sources.

3. Socially Conscious Jewelry Industry - Jewelry companies can create socially conscious lines that have a dual purpose: benefiting disadvantaged communities and cultures while offering unique and aesthetically pleasing accessories.

6 Featured, 54 Examples:

177,879 Total Clicks

Date Range:

Apr 13 — Dec 14

Trending:

Average

Consumer Insight Topics: