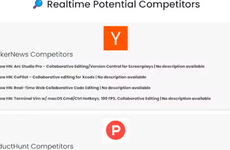

Discover if Growth in Crowdfunding Statistics Can Help Your Business

References: gogetfunding & blog.gogetfunding

Taking a look at the crowdfunding statistics outlined in this business infographic by GoGetFunding provides you with a good idea of whether or not your business or start-up may benefit from a crowdfunding campaign.

There are well over 500 platforms through which entrepreneurs can involve the public in turning their business ideas into a reality and this number grows each year. In 2013 alone, an estimated $5.1 billion was raised through these platforms, nearly double the funds raised in 2012. Surprisingly, reward-based funding projects have seen more growth than lending funds, which benefits smaller businesses as they can save on costs.

As this infographic demonstrates, the crowdfunding statistics promise even more growth with each coming year.

There are well over 500 platforms through which entrepreneurs can involve the public in turning their business ideas into a reality and this number grows each year. In 2013 alone, an estimated $5.1 billion was raised through these platforms, nearly double the funds raised in 2012. Surprisingly, reward-based funding projects have seen more growth than lending funds, which benefits smaller businesses as they can save on costs.

As this infographic demonstrates, the crowdfunding statistics promise even more growth with each coming year.

Trend Themes

1. Crowdfunding Statistics - Disruptive innovation opportunity: Develop a data analytics platform to analyze crowdfunding statistics and provide insights for businesses to optimize their crowdfunding campaigns.

2. Crowdfunding Platforms - Disruptive innovation opportunity: Create a platform that aggregates multiple crowdfunding platforms, providing a one-stop-shop for entrepreneurs and investors.

3. Growth in Reward-based Funding - Disruptive innovation opportunity: Design a marketplace that connects businesses with specialized service providers who offer rewards to backers, increasing the value and attractiveness of reward-based funding projects.

Industry Implications

1. Data Analytics - Disruptive innovation opportunity: Develop advanced algorithms and machine learning techniques to process and analyze crowdfunding data, enabling data-driven decision-making in various industries.

2. Fintech - Disruptive innovation opportunity: Build innovative financial technology solutions that enhance the efficiency and accessibility of crowdfunding platforms, improving the overall user experience for businesses and investors.

3. E-commerce - Disruptive innovation opportunity: Create an e-commerce platform specifically tailored for crowdfunding campaigns, allowing businesses to seamlessly showcase and sell their products or services to potential backers.

1.9

Score

Popularity

Activity

Freshness