The 'hellomerci' Platform Helps You Get a Loan While Avoiding the Bank

Alexander Lam — June 20, 2013 — Business

References: hellomerci & springwise

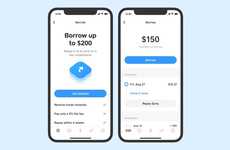

Taking inspiration from sites such as Kickstarter and Indiegogo, the 'hellomerci' platform is using crowdfunding to help you get a loan. The online platform aims to help you circumvent traditional institutions such as banks and credit unions and get a loan from your peers.

Using hellomerci, users can create a page and ask for a loan to reach a goal. The fundraising page asks that you describe your project, set the amount needed and explain how you will repay. If the required money is raised, the fundraiser gets their money and the lenders receive monthly payments. However, if the goal isn't reached, no money exchanges hands and no fees are charged. The only fee is a one-time charge of three to six percent of the loan.

Using hellomerci, users can create a page and ask for a loan to reach a goal. The fundraising page asks that you describe your project, set the amount needed and explain how you will repay. If the required money is raised, the fundraiser gets their money and the lenders receive monthly payments. However, if the goal isn't reached, no money exchanges hands and no fees are charged. The only fee is a one-time charge of three to six percent of the loan.

Trend Themes

1. Crowdfunding Loans - Platforms like 'hellomerci' are using crowdfunding to offer an alternative to traditional bank loans.

2. P2P Lending - Peer-to-peer lending platforms are becoming more popular for those seeking loans.

3. Alternative Finance - Platforms like 'hellomerci' are part of a growing trend of alternative financing options.

Industry Implications

1. Banking and Finance - Traditional banks and credit unions need to innovate in order to compete with peer-to-peer lending platforms and crowdfunding options.

2. Fintech - Fintech companies have an opportunity to create innovative platforms that combine crowdfunding and peer-to-peer lending.

3. Small Business - Small businesses have an opportunity to access funding through crowdfunding and peer-to-peer lending platforms, bypassing traditional banking options.

1.8

Score

Popularity

Activity

Freshness