The Impact Economy Innovations Fund Works in Asia

Tiana Reid — May 14, 2013 — Social Good

References: asiacommunityventures.org & socialfinance

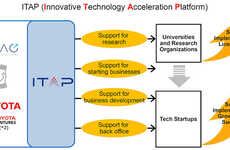

The Impact Economy Innovations Fund (IEIF) is a new creation by Asia Community Ventures and the Rockefeller Foundation. It was launched earlier this year specifically for the East and Southeast Asia Impact Investing Forum and intends to focus on early-stage capital and attempting to support entrepreneurship in a holistic way.

In "Connecting the Dots of Impact Investing in Asia," Remi Kanji, a writer for MaRS' Social Finance web publication who went to the forum in Hong Kong was relatively positive about the Impact Economy Innovations Fund's possibility in order to connect capital with social problems, a gap that the Rockefeller's name could bring a bit of pressure to -- for better or for worse.

Contact Information

Asia Community Ventures website

ACV on Facebook

ACV on Twitter

ACV on LinkedIn

In "Connecting the Dots of Impact Investing in Asia," Remi Kanji, a writer for MaRS' Social Finance web publication who went to the forum in Hong Kong was relatively positive about the Impact Economy Innovations Fund's possibility in order to connect capital with social problems, a gap that the Rockefeller's name could bring a bit of pressure to -- for better or for worse.

Contact Information

Asia Community Ventures website

ACV on Facebook

ACV on Twitter

ACV on LinkedIn

Trend Themes

1. Impact Investing - Disruptive innovation opportunity: Developing innovative investment strategies that generate measurable social and environmental impact alongside financial returns.

2. Entrepreneurship Support - Disruptive innovation opportunity: Creating comprehensive programs and platforms to provide early-stage capital and holistic support for entrepreneurs.

3. Social Finance - Disruptive innovation opportunity: Advancing financial models and tools that drive positive social and environmental outcomes while delivering financial value.

Industry Implications

1. Investment - Disruptive innovation opportunity: Introducing impact investment funds and platforms that connect capital with social and environmental challenges.

2. Startup Support Services - Disruptive innovation opportunity: Offering integrated services and resources for early-stage entrepreneurs, including capital, mentorship, and advisory support.

3. Financial Technology - Disruptive innovation opportunity: Leveraging technology to develop sustainable finance solutions that align with impact investing principles and objectives.

1.1

Score

Popularity

Activity

Freshness