Budgeting and savings apps are used by Millennials to prevent impulse purchases

Trend - While personal finance management apps have existed for over a decade, the introduction of artificial intelligence (AI) and data collection algorithms have made recent apps far more effective than before. These modern budgeting apps are used to prevent unnecessary spending while saving toward goals.

Insight - The extensive convenience of modern e-commerce platforms, such as Aliexpress, Temu, or Amazon, has led to consumers from Gen Z to older Millennials constantly facing targeted product advertising. This has led to an impulse spending problem in many consumers who purchase frequent low-cost products, unaware of how quickly these purchases add up. More tech-savvy Gen Z and Millennial consumers, in an effort to curb this aspect of e-commerce culture, are turning to budgeting apps powered by AI.

Insight - The extensive convenience of modern e-commerce platforms, such as Aliexpress, Temu, or Amazon, has led to consumers from Gen Z to older Millennials constantly facing targeted product advertising. This has led to an impulse spending problem in many consumers who purchase frequent low-cost products, unaware of how quickly these purchases add up. More tech-savvy Gen Z and Millennial consumers, in an effort to curb this aspect of e-commerce culture, are turning to budgeting apps powered by AI.

Workshop Question - How can your brand leverage AI and data collection to help its customers make more informed purchasing decisions?

Trend Themes

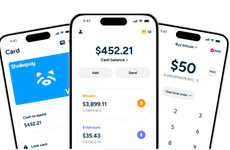

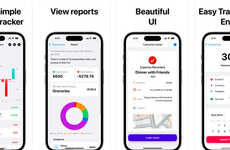

1. AI-enhanced Personal Finance - Modern budgeting apps like Cleo and Monarch utilize artificial intelligence to deliver personalized financial advice and interactive money management solutions.

2. User-centric Financial Tools - Apps such as Windfall and Apollo focus on providing a delightful user interface and privacy-focused features to increase user engagement and trust.

3. E-commerce Integration - Platforms like SaveStrike integrate seamlessly with various online shops to help users manage wishlists and earn cashback, simplifying the online shopping experience.

Industry Implications

1. Fintech - The Fintech industry benefits from innovations in AI-powered budgeting apps that streamline personal financial management and enhance user experience.

2. E-commerce - Incorporating digital tools like SaveStrike into the E-Commerce sphere allows consumers to manage wishlists and receive cashback, driving more efficient shopping behavior.

3. Data Analytics - Data-driven insights from apps like Monarch and Apollo enable industries to offer tailored financial solutions and identify spending trends effectively.