The Goalkeeper Money-Saving App Helps You Achieve Financial Objectives

Laura McQuarrie — January 22, 2015 — Tech

References: itunes.apple & marketingmag

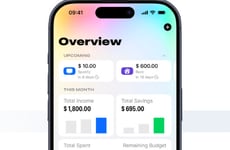

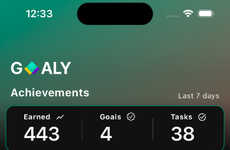

Standard Life Canada's money saving app was developed with Millennials in mind, serving as a handy guide to saving money on a daily basis. To get you started, the app has you create or choose a popular mission to work towards, such as saving up for retirement, a trip, a house, your education or a goal to pay off debt.

From there, the Goalkeeper app makes it easy to follow through, suggesting things that can be done on a daily basis to keep this goal within reach. For instance, the app may suggest that you bring your lunch to work each day of the week instead of buying it. In order to make financial planning seem much less daunting, this app tackles the small stuff first. Jean-Sebastien Monty, president of the U92 company that's responsible for designing the app, notes that Goalkeeper makes it "extremely easy for someone to understand how it can affect their immediate life today. So, no popcorn at the movies, or one less coffee."

From there, the Goalkeeper app makes it easy to follow through, suggesting things that can be done on a daily basis to keep this goal within reach. For instance, the app may suggest that you bring your lunch to work each day of the week instead of buying it. In order to make financial planning seem much less daunting, this app tackles the small stuff first. Jean-Sebastien Monty, president of the U92 company that's responsible for designing the app, notes that Goalkeeper makes it "extremely easy for someone to understand how it can affect their immediate life today. So, no popcorn at the movies, or one less coffee."

Trend Themes

1. Personalized Saving Apps - There is a demand for more apps that provide personalized guidance and motivation to help people save money and achieve financial objectives.

2. Micro-tasking Financial Apps - Apps that provide simple and manageable daily tasks to help users stay on track with their financial goals are gaining popularity.

3. Gamification of Personal Finance - Apps that incorporate gamification elements to make saving money feel like a game and increase user engagement are becoming more common.

Industry Implications

1. Fintech - FinTech companies can take advantage of the growing demand for customized and user-friendly personal finance apps to develop new products and services that cater to specific audiences.

2. Mobile App Development - The development and design of mobile apps that offer personalized and gamified financial solutions can provide new opportunities for app developers.

3. Retail - Retailers can partner with personal finance apps to offer discounts or rewards to users who achieve their financial goals, creating a win-win situation for both parties.

3.3

Score

Popularity

Activity

Freshness