'Wilbur' Helps Adults Get their Financials Back on Track

Colin Smith — March 28, 2024 — Lifestyle

References: wilburbudget & findependencehub

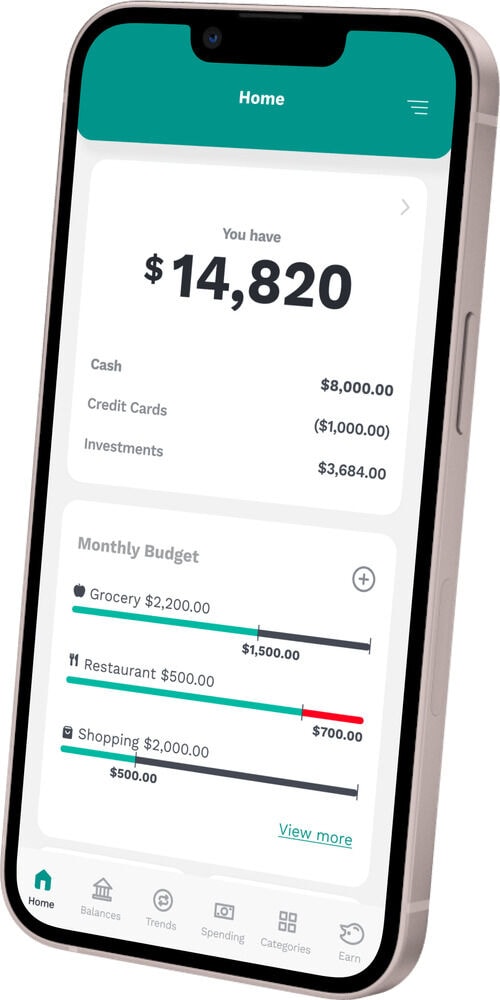

The Wilbur budgeting app, developed by Square Knot Analytics Inc., is designed to provide users with a comprehensive view of their financial health. Wilbur is an excellent tool for the aging population as they aim to manage their finances to save up for larger goals, such as paying for their kids' schooling, paying for retirement, or paying off a home. It achieves this by summarizing financial information from linked bank accounts, credit cards, loans, and investments. The app’s primary goal is to help users take control of their finances through features that automatically track income and expenses, thereby facilitating the creation of a personalized budget. Wilbur stands out as a 100% free budgeting tool, with no advertising or paid options, ensuring that every user has access to all of its features.

In addition to budgeting, Wilbur offers unique opportunities for users to earn money and rewards by sharing their opinions through surveys. This feature not only provides financial incentives but also allows users to influence the development of products and services they use. The app emphasizes data security, employing bank-grade encryption technology and firewalls to protect user data. It assures that personal information is never used for marketing purposes and is securely housed within Canada on Amazon Web Services.

Image Credit: Wilbur

In addition to budgeting, Wilbur offers unique opportunities for users to earn money and rewards by sharing their opinions through surveys. This feature not only provides financial incentives but also allows users to influence the development of products and services they use. The app emphasizes data security, employing bank-grade encryption technology and firewalls to protect user data. It assures that personal information is never used for marketing purposes and is securely housed within Canada on Amazon Web Services.

Image Credit: Wilbur

Trend Themes

1. AI-powered Financial Management - Leveraging AI to automate budget tracking and provide personalized financial insights for users.

2. User-driven Rewards Programs - Integrating incentives like surveys for users to earn money and influence product development.

3. Enhanced Data Security Measures - Implementing bank-grade encryption and secure cloud storage to protect user information.

Industry Implications

1. Fintech - Innovating financial technology solutions to revolutionize personal budgeting and financial management.

2. Market Research - Utilizing user feedback and opinions to drive product development and enhance customer engagement.

3. Cybersecurity - Developing advanced encryption technologies to safeguard sensitive data and protect user privacy.

5.2

Score

Popularity

Activity

Freshness