The 'Finn' App Can Provide Accurate Responses to Complex Queries

Rahul Kalvapalle — February 2, 2024 — Tech

References: press.bunq & thenextweb

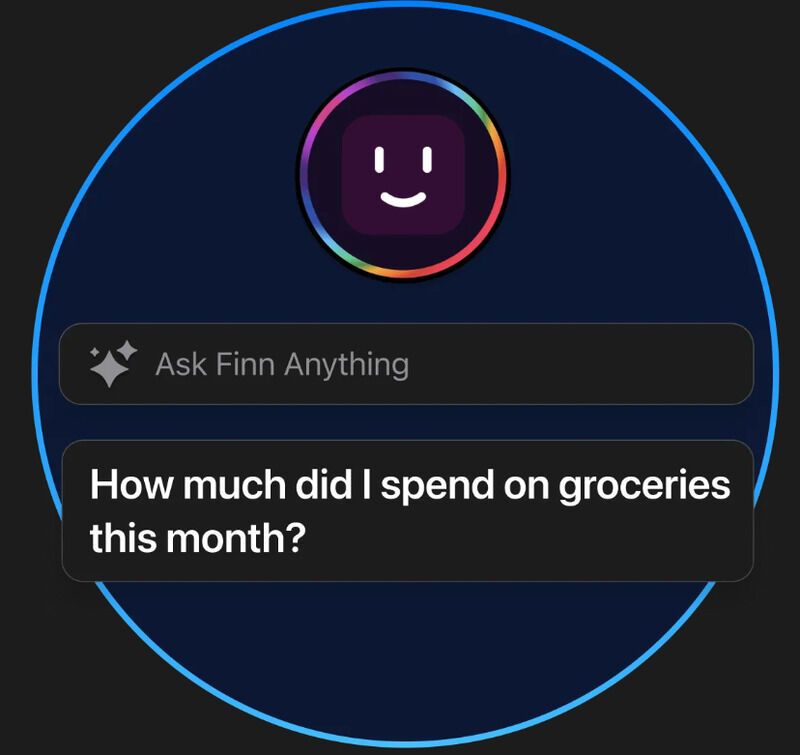

Digital-first bank Bunq has launched a brand new finance app that is designed to make it possible for the neobank's clients to go about leveraging the power of generative AI in order to keep track of their finances, boost their budgeting activities and generally keep their money matters organized.

The 'Finn' finance app makes use of large language models in order to make it possible to provide responses to questions and inquiries. Rather than simply direct clients to online resources like more low-brow chatbots, this particular platform can answer highly specific questions on average spending, targeting expenditures and specific monetary transactions.

Ali Niknam, founder and CEO over at Bunq, stated that this finance app is guaranteed to impress and assist. “Years of AI innovation, coupled with laser focus on our users, allowed us to completely transform banking as you know it," Niknam said. "Seeing Generative AI make life so much easier for our users is incredibly exciting.”

Image Credit: Bunq

The 'Finn' finance app makes use of large language models in order to make it possible to provide responses to questions and inquiries. Rather than simply direct clients to online resources like more low-brow chatbots, this particular platform can answer highly specific questions on average spending, targeting expenditures and specific monetary transactions.

Ali Niknam, founder and CEO over at Bunq, stated that this finance app is guaranteed to impress and assist. “Years of AI innovation, coupled with laser focus on our users, allowed us to completely transform banking as you know it," Niknam said. "Seeing Generative AI make life so much easier for our users is incredibly exciting.”

Image Credit: Bunq

Trend Themes

1. Generative AI - Utilizing large language models, finance apps like 'Finn' can provide accurate responses to highly specific financial inquiries.

2. Budgeting Activities - The 'Finn' app enables users to boost their budgeting activities by keeping track of average spending and targeting expenditures.

3. Digital-first Banking - The launch of the 'Finn' finance app by Bunq showcases the innovation in digital-first banking and transforms the traditional banking experience.

Industry Implications

1. Banking - The 'Finn' finance app disrupts the banking industry by leveraging generative AI to provide personalized financial assistance.

2. Financial Technology - The use of generative AI in finance apps like 'Finn' presents disruptive innovation opportunities in the financial technology sector.

3. Personal Finance - The 'Finn' app revolutionizes personal finance management by offering accurate responses to specific monetary transactions and organizing money matters.

7.8

Score

Popularity

Activity

Freshness