Era's AI Wealth Platform Secures $3.1M Seed Funding

Grace Mahas — November 17, 2023 — Tech

References: finextra

In the ever-evolving realm of wealth management, Era, a new AI-powered platform, has made a significant entry with a successful $3.1 million seed funding round. Led by Northzone, with contributions from Protagonist and Designer Fun, Era represents a collaboration of tech veterans from Stripe and Square, bringing cutting-edge technology to personal finance.

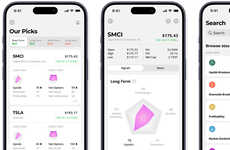

Founded by CEO Alex Norcliffe, former head of design and product at Stripe with experience at Square, and COO Lindsay Brady, a Stripe and Google alum, Era stands out for its unique approach to wealth management. The platform skillfully combines the expertise of human advisors with advanced AI technology to offer personalized financial advice and automate routine financial tasks. This includes estimating taxes and managing account transfers, making financial planning more efficient and user-friendly.

Era distinguishes itself by integrating market news and macroeconomic data into its AI algorithms, enhancing the quality of its recommendations. This feature enables users to stay informed about how various economic factors, such as company earnings, job reports, and government policies, impact their finances and investment portfolios.

Norcliffe emphasizes Era's mission to democratize financial expertise, stating, "Finance shouldn't be a maze that only a few can navigate. At Era, we're reshaping the financial landscape to make expert advice attainable for everyone, irrespective of their existing knowledge or funds in their bank account." This statement underscores Era's commitment to making sophisticated financial guidance accessible to a broader audience, leveraging AI to bridge the gap between financial access and ambition.

Image Credit: Shutterstock

Founded by CEO Alex Norcliffe, former head of design and product at Stripe with experience at Square, and COO Lindsay Brady, a Stripe and Google alum, Era stands out for its unique approach to wealth management. The platform skillfully combines the expertise of human advisors with advanced AI technology to offer personalized financial advice and automate routine financial tasks. This includes estimating taxes and managing account transfers, making financial planning more efficient and user-friendly.

Era distinguishes itself by integrating market news and macroeconomic data into its AI algorithms, enhancing the quality of its recommendations. This feature enables users to stay informed about how various economic factors, such as company earnings, job reports, and government policies, impact their finances and investment portfolios.

Norcliffe emphasizes Era's mission to democratize financial expertise, stating, "Finance shouldn't be a maze that only a few can navigate. At Era, we're reshaping the financial landscape to make expert advice attainable for everyone, irrespective of their existing knowledge or funds in their bank account." This statement underscores Era's commitment to making sophisticated financial guidance accessible to a broader audience, leveraging AI to bridge the gap between financial access and ambition.

Image Credit: Shutterstock

Trend Themes

1. AI-powered Wealth Management - Era's AI technology offers personalized financial advice and automates routine financial tasks, making financial planning more efficient.

2. Integration of Market News and Data - Era enhances the quality of its recommendations by integrating market news and macroeconomic data into its AI algorithms.

3. Democratization of Financial Expertise - Era is reshaping the financial landscape by making expert advice attainable for everyone, irrespective of their existing knowledge or funds.

Industry Implications

1. Wealth Management - Era's AI-powered platform revolutionizes the way wealth management is conducted.

2. Financial Technology (fintech) - Era's use of cutting-edge AI technology disrupts the traditional financial technology industry.

3. Personal Finance - Era's innovative approach to combining human advisors with AI technology disrupts the personal finance industry.

5.7

Score

Popularity

Activity

Freshness