Revolut Introduces its Reliable AI-Powered Finance Product, Billpay

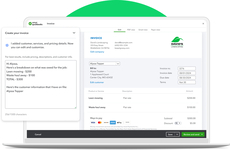

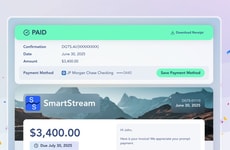

Revolut is unveiling its latest groundbreaking product tailored specifically for finance leaders: Billpay. This cutting-edge solution leverages the power of artificial intelligence to revolutionize accounting functions, promising to streamline processes and enhance efficiency within businesses.

Billpay empowers businesses to effortlessly import invoices, extract crucial data, and execute transfers with requisite approvals. This automated workflow not only saves time but also minimizes the risk of errors, ensuring accuracy and compliance at every step.

One of the key advantages of Billpay is its integration within Revolut's comprehensive business account ecosystem. This integration fosters synergy between various financial functions, allowing for easy and streamlined access to core features. Revolut aims to carve out a significant market share and establish Billpay as the go-to solution for finance professionals across the globe.

Image Credit: Miha Creative

Billpay empowers businesses to effortlessly import invoices, extract crucial data, and execute transfers with requisite approvals. This automated workflow not only saves time but also minimizes the risk of errors, ensuring accuracy and compliance at every step.

One of the key advantages of Billpay is its integration within Revolut's comprehensive business account ecosystem. This integration fosters synergy between various financial functions, allowing for easy and streamlined access to core features. Revolut aims to carve out a significant market share and establish Billpay as the go-to solution for finance professionals across the globe.

Image Credit: Miha Creative

Trend Themes

1. AI-powered Finance Solutions - Explore the disruptive innovation opportunities in leveraging AI to streamline accounting functions and enhance efficiency within businesses.

2. Automated Workflow Technologies - Discover the potential for automated workflows to save time, minimize errors, ensure accuracy, and enhance compliance in finance operations.

3. Integrated Business Account Ecosystems - Unlock the benefits of integrating various financial functions within a comprehensive business account ecosystem for easy access to core features.

Industry Implications

1. Finance Technology - The finance technology sector presents opportunities for disruptive innovation through AI-powered solutions and automated workflow technologies.

2. Accounting Software - In the accounting software industry, integrating with integrated business account ecosystems can enhance accessibility and streamline financial operations.

3. Digital Banking Services - Digital banking services providers can differentiate themselves by adopting AI-powered finance solutions that revolutionize accounting functions for businesses.

7.4

Score

Popularity

Activity

Freshness