Identity theft-avoiding apps and products target Millennials

Implications - Brands are using tech and apps to target Millennials, offering streamlined and effortless ways to protect them from identity theft and other forms of fraud. This shift aims to prevent scams, as it has been shown that Millennials are the most likely demographic to fall for them – for reasons such as job seeking and the large amount of time they spend online.

Workshop Question - How can your brand better accommodate any generational needs or concerns within its area of expertise?

Trend Themes

1. Identity Theft-preventing Apps - Online platforms that prevent identity theft before it happens by sending push notifications to smartphone users when their social security number is used can disrupt the identity theft prevention industry.

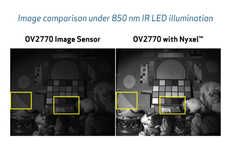

2. Biometric Credit Cards - Adding an extra layer of security with biometric technology in credit cards can disrupt the credit card industry by ensuring consumer safety and reducing identity theft.

3. Social Media ID Systems - An electronic ID system using facial recognition technology and artificial intelligence has the potential to deter online identity theft and will disrupt the identity verification industry.

Industry Implications

1. Identity Theft Prevention - These trends in identity theft prevention apps, biometric credit cards, and social media electronic ID systems have potential for growth and disruption in the identity theft prevention industry.

2. Payment and Credit Card Management - Consolidated credit card apps and biometric credit cards have potential for growth and disruption in the payment and credit card management industry.

3. Online Safety and Privacy - Scam-prevention tests and call-blocking security apps have potential for growth and disruption in the online safety and privacy industry.