Visa ID Intelligence is an API Offering That Uses Face Scans for Security

Alyson Wyers — October 22, 2017 — Tech

References: fastcompany

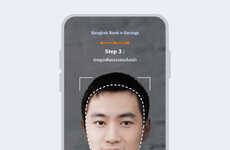

According to a recent statement, Visa wants to start using face scans instead of bank passwords. The credit card company announced a new API-based biometric service available to banks and merchants called Visa ID Intelligence. Visa Senior Vice President for risk products Mark Nelsen explained: "It's a way for us to accelerate the adoption of these smarter authentification technologies for our clients around the world."

The application programming interface enables organizations working with sensitive financial information to address evolving security threats. Smartphones already integrate thumbprints, such as Touch ID on iPhones, and face scans are employed at some airports as an added measure of security. Banks, however, have been slower to incorporate newer biometric tactics.

The application programming interface enables organizations working with sensitive financial information to address evolving security threats. Smartphones already integrate thumbprints, such as Touch ID on iPhones, and face scans are employed at some airports as an added measure of security. Banks, however, have been slower to incorporate newer biometric tactics.

Trend Themes

1. Biometric Authentication - Disruptive innovation opportunity: Develop advanced biometric authentication solutions for banks and merchants to enhance security and streamline user authentication processes.

2. Api-based Security Services - Disruptive innovation opportunity: Create API-based security services that enable organizations to implement biometric authentication and address evolving security threats in the financial industry.

3. Consumer-facing Biometric Technology - Disruptive innovation opportunity: Design consumer-friendly biometric technologies that facilitate secure and seamless authentication experiences for banking customers.

Industry Implications

1. Financial Services - Disruptive innovation opportunity: Integrate biometric authentication solutions into financial services to enhance security measures and improve customer experience.

2. Technology - Disruptive innovation opportunity: Develop innovative biometric technologies and solutions for the technology industry to support the implementation of advanced security measures.

3. Mobile Device Manufacturing - Disruptive innovation opportunity: Collaborate with banks and financial institutions to incorporate biometric authentication features into mobile devices, providing users with more secure access to their financial information.

4.9

Score

Popularity

Activity

Freshness