Credit and debit cards are designed with analog buttons

Implications - Banking institutions are giving consumers the ability to interact with dynamic credit and debit cards, differentiated by analog buttons. While the specific functions of these buttons can vary, the increased appearance of this feature suggests that in today's chaotic and contactless world, some still desire the gratification of haptic feedback.

Workshop Question - What analog process could your brand re-introduce to differentiate it's offering?

Trend Themes

1. Analog Button Integration - Incorporating analog buttons on credit and debit cards for enhanced interaction with customers.

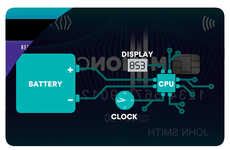

2. Real-time Budgeting Cards - Development of physical cards for monitoring and managing financial resources in real time.

3. Dynamic Wallet Cards - Development of compact and high-tech solution to consolidate multiple debit, credit, and loyalty cards.

Industry Implications

1. Fintech - Companies within the FinTech industry can take advantage of analog button integration to offer customized solutions for managing finances.

2. Payment Processing - Payment processing companies can develop innovative solutions for real-time budgeting cards and dynamic wallet cards for a more secure and streamlined payment process

3. Banking - Banks can use real-time budgeting cards and dynamic wallet cards as a competitive offering and button-integrated bank cards to enhance customer interaction and provide flexible payment options.

4 Featured, 34 Examples:

58,940 Total Clicks

Date Range:

Aug 17 — Nov 18

Trending:

Warm

Consumer Insight Topics: