Samsung Pay Users Can Now Use Bixby to Initiate Transactions

Laura McQuarrie — June 6, 2017 — Tech

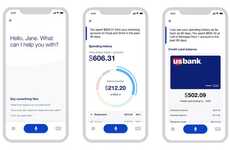

In South Korea, Samsung Pay users with the latest Samsung devices are now able to make the most of Bixby to begin a transaction using only their voice.

Bixby is the artificially intelligent virtual assistant included on the Galaxy S8 and S8+, which now makes it possible to carry out P2P transfers and look into one's account balance with ease. Although the payment process may be initiated by a voice command, users will be required to use a biometric scan of an iris or fingerprint with Samsung Pass to complete a desired action.

Customers of the Woori Bank, Shinhan Bank and KEB Hana Bank with bank cards issued by Samsung Pay are now able to start initiating payments via compatible Samsung devices with Bixby.

Bixby is the artificially intelligent virtual assistant included on the Galaxy S8 and S8+, which now makes it possible to carry out P2P transfers and look into one's account balance with ease. Although the payment process may be initiated by a voice command, users will be required to use a biometric scan of an iris or fingerprint with Samsung Pass to complete a desired action.

Customers of the Woori Bank, Shinhan Bank and KEB Hana Bank with bank cards issued by Samsung Pay are now able to start initiating payments via compatible Samsung devices with Bixby.

Trend Themes

1. Voice-controlled Payments - Samsung Pay's integration of Bixby AI opens up voice-controlled payment options, paving the way for other payment providers to follow suit.

2. AI-powered Virtual Assistants - The role of virtual assistants such as Bixby in facilitating financial transactions and services is set to expand, presenting opportunities for payment providers, banks, and FinTech companies to innovate with similar voice-activated platforms.

3. Biometric Security - Samsung Pass's use of biometric authentication in payment authorizations sets a new standard for secure mobile payments, driving demand for other forms of biometric security and creating new business opportunities for providers of such technologies.

Industry Implications

1. Mobile Payments - Voice-controlled payments through mobile devices powered by AI have immense potential to disrupt the traditional payments landscape, representing a major opportunity for companies involved in mobile payments, from startups to established tech companies.

2. Financial Services - The expanding role of virtual assistants in financial services represents a significant innovation opportunity, as banks and other financial services providers can integrate voice-powered financial management and advice tools into their existing services.

3. Biometric Security Services - The integration of biometric security in mobile payments authorizations presents a disruptive innovation opportunity for suppliers of biometric authentication services and hardware, from fingerprint and facial recognition technologies to iris scanners and beyond.

1

Score

Popularity

Activity

Freshness