imaginBank is Spain's First Mobile-Only Bank for Millennials

Katherine Pendrill — June 6, 2017 — Tech

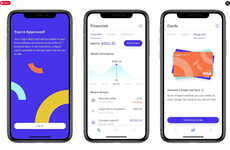

Last year, Spain's CaixaBank launched the country's first mobile-only bank for millennials, imaginBank. A radical change from the multi-channel approach adopted by most banks, imaginBank provides young users with services that can only be accessed through its mobile applications and social networks.

imaginBank is a mobile banking app that allows users to make basic transactions, pay bills and make payments. As CaixaBank explains, "users are able to manage their finances in a fully independent manner, with the support of 'intelligent' tech tools to allow continuous monitoring of their personal finances." The app even features fully customizable graphics and expenditure targets so Millennials can personalize the platform to suit their needs.

With most millennials turning their phone into a personal finance tool, imaginBank is likely to appeal to younger consumers.

imaginBank is a mobile banking app that allows users to make basic transactions, pay bills and make payments. As CaixaBank explains, "users are able to manage their finances in a fully independent manner, with the support of 'intelligent' tech tools to allow continuous monitoring of their personal finances." The app even features fully customizable graphics and expenditure targets so Millennials can personalize the platform to suit their needs.

With most millennials turning their phone into a personal finance tool, imaginBank is likely to appeal to younger consumers.

Trend Themes

1. Mobile-only Bank - Development of mobile-only banks around the world can be profitable and disruptive to traditional banking systems.

2. Personalized Financial Management - Providing customers with personalized financial management tools can attract the millennial market.

3. Social Media Integration - Integrating social media with banking services can lead to increased engagement and brand loyalty among millennials.

Industry Implications

1. Banking - Traditional banking systems can be disrupted by the development of mobile-only banks targeting younger generations.

2. Mobile Technology - Advancements in mobile technology can be utilized to provide personalized financial management tools to younger generations.

3. Social Media - Social media platforms can be leveraged to increase engagement and accessibility of modern banking services.

2.2

Score

Popularity

Activity

Freshness