Investing for young Gen Z consumers is made easier with apps and communities

Trend - Gen Z is entering a new world of fintech, and banking apps, community platforms and services are being designed to help them navigate investing in the modern age. These platforms ensure that young consumers are able to set themselves up for the future in today's changing financial landscape.

Insight - Banking and investment services aren't just about monetary exchanges, but cryptocurrencies and apps that give users more autonomy over their money. This changing financial landscape has a learning curve, and more consumers are pushing for financial literacy being tackled within the education system to address this. With the North American education system still lagging behind, some brands and communities are helping to fill that gap.

Insight - Banking and investment services aren't just about monetary exchanges, but cryptocurrencies and apps that give users more autonomy over their money. This changing financial landscape has a learning curve, and more consumers are pushing for financial literacy being tackled within the education system to address this. With the North American education system still lagging behind, some brands and communities are helping to fill that gap.

Workshop Question - How could your brand better prioritize customer education and support?

Trend Themes

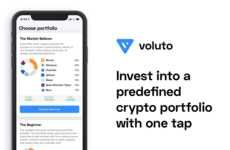

1. Next-gen Investment Platforms - Investment and banking apps are being designed to cater to a young audience with a focus on cryptocurrencies and financial literacy.

2. Virtual Influencers in Finance - Virtual influencers are being used to target millennials and Gen Z by offering relatable and approachable messaging on financial investment markets.

3. Teen-centric Investment Apps - Investment apps targeting teenagers are providing educational modules and tools to help them explore the world of responsible investing and build financial literacy.

Industry Implications

1. Fintech Industry - Fintech companies are developing investment and banking apps to help young consumers navigate the changing financial landscape.

2. Influencer Marketing Industry - Virtual influencers are becoming a popular marketing tool in the finance and investment industry to target younger audiences.

3. Education Industry - There is a growing need for financial literacy education to be integrated into the education system to address the learning curve presented by the changing financial landscape.

7 Featured, 61 Examples:

68,561 Total Clicks

Date Range:

Apr 21 — Jul 23

Trending:

Average

Consumer Insight Topics: