Grifin Was Designed as an Investing Apps for First Timers

Grace Mahas — February 17, 2021 — Business

References: apps.apple

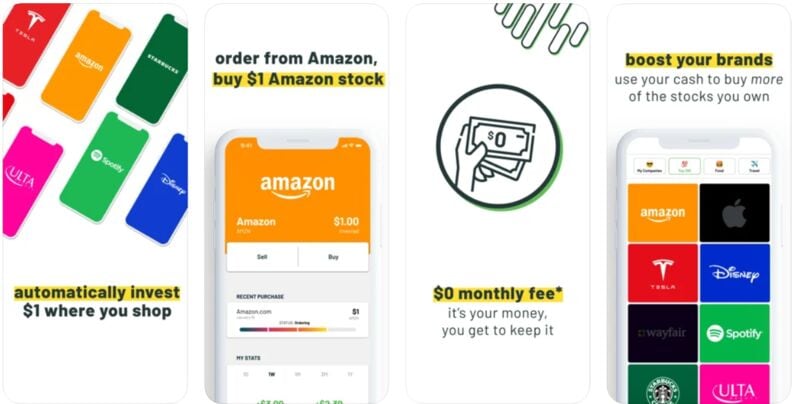

Grifin is an investing app that allows users to automatically start investing through their everyday purchases. For example, if you spend $5 grabbing a latter at Starbucks, the app will automatically invest $1 in Starbucks stock. On the other hand, if you order lunch through DoorDash, the app will invest $1 in their stock.

Grifin was launched by Aaron Froug, a 26 years old with a passion for financial literacy and a background in behavioral economist. Aaron created the app for first-time investors looking for financial platforms that provide "guardrails" so to speak.

Grifin allows users can also set a limit on how much to invest each month and can only buy and sell stock on Grifin one time per day. The user must unlock a company through a purchase before having access to manually buy with their cash account. Plus, users can even disable companies that they don’t want to invest in.

Image Credit: Grifin

Grifin was launched by Aaron Froug, a 26 years old with a passion for financial literacy and a background in behavioral economist. Aaron created the app for first-time investors looking for financial platforms that provide "guardrails" so to speak.

Grifin allows users can also set a limit on how much to invest each month and can only buy and sell stock on Grifin one time per day. The user must unlock a company through a purchase before having access to manually buy with their cash account. Plus, users can even disable companies that they don’t want to invest in.

Image Credit: Grifin

Trend Themes

1. Automated Investing - Opportunity to develop investing apps that allow users to easily and automatically invest through their everyday purchases.

2. Behavioral Finance - Opportunity to incorporate behavioral economic principles into investment apps, making it easier for first-time investors to make sound financial decisions.

3. Micro-investing - Opportunity to develop apps that allow users to invest small amounts based on their daily spending habits, encouraging users to invest even if they don't have a lot of money to put towards traditional investment accounts.

Industry Implications

1. Financial Technology - Opportunity for FinTech companies to further simplify investing for first-time investors with easy-to-use apps and behavioral finance principles.

2. Retail - Opportunity for retailers to partner with investment apps to offer their customers an easy and automated way to invest based on their daily spending habits.

3. Food Delivery - Opportunity for food delivery companies to offer investment options to customers when they place an order, which could potentially increase customer loyalty and engagement.

6.8

Score

Popularity

Activity

Freshness