This Service is Targeted Towards 'Bangkok Bank' Customers

Rahul Kalvapalle — March 25, 2022 — Business

References: bangkokbank & bangkokbankinnohub

Bangkok Bank, one of Thailand's largest commercial banks, has launched an innovative new ID verification service that is designed to make it easier than ever for customers to go about carrying out financial transactions, payments and other online banking processes with greater peace of mind.

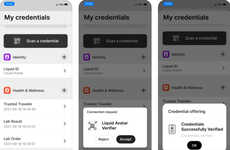

The Mobile ID verification service requires customers to register for the 'Atta' smartphone app, before going through the verification process to confirm their identity. This then allows them to perform both online and in-person banking transactions without having to present paper documents or personal identification, with users able to use their Mobile ID in place of conventional identity cards.

The advent of Bangkok Bank's Mobile ID verification service is said to be the result of a growing understanding of the need to accurately verify customer identities using new technology and innovation, particularly to cater to the younger generation of customers.

Image Credit: Bangkok Bank

The Mobile ID verification service requires customers to register for the 'Atta' smartphone app, before going through the verification process to confirm their identity. This then allows them to perform both online and in-person banking transactions without having to present paper documents or personal identification, with users able to use their Mobile ID in place of conventional identity cards.

The advent of Bangkok Bank's Mobile ID verification service is said to be the result of a growing understanding of the need to accurately verify customer identities using new technology and innovation, particularly to cater to the younger generation of customers.

Image Credit: Bangkok Bank

Trend Themes

1. Mobile ID Verification - The use of mobile technology for ID verification and authentication, improving ease and accessibility for customers.

2. Digital Banking - Increased adoption of digital banking services to simplify financial transactions and provide customers with greater access to their finances.

3. Blockchain Solutions for Identity Verification - Blockchain technology can provide secure and transparent identity verification, creating a more efficient and cost-effective solution for financial institutions.

Industry Implications

1. Banking and Finance - There is a growing need for innovation and technology in the banking and finance industry to cater to the younger generation of customers.

2. Mobile App Development - Mobile app developers can leverage the demand for mobile ID verification services and partner with financial institutions to improve customer experiences.

3. Blockchain Technology - Blockchain technology can provide an unprecedented level of security for identity verification, creating opportunities for innovative solutions in the financial industry.

2.2

Score

Popularity

Activity

Freshness