Mono Prides Itself on Being a Pioneer in the Fintech Industry

References: cuentamono & techcrunch

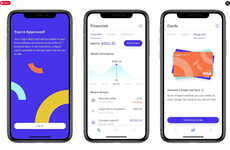

Salomon Zarruk and Sebastian Ortiz have worked together to pioneer Mono, a financial technology company that provides corporations with banking accounts tailored to their business needs. Mono translates to “monkey” in Spanish, which symbolizes rebirth and new growth. Mono is advertised as “the first bankingless bank” for small businesses and startups.

"The company’s name is inspired from what happens after there is a fire in the forest," José Tomás Lobo explained. "Though the whole land is black and filled with ashes, it is still fertile, and when the monkeys start going from tree-to-tree eating seeds, they drop many of the seeds on the ground, which become new growth."

Mono offers debit and credit services that can be used for transfers and payments, operating in cooperation with a banking institution from Colombia. The company has plans to expand throughout South America to countries like Mexico, Peru, Chile, and Brazil. The company remains on the cutting edge of financial services with its fast and efficient approach to banking.

Image Credit: Mono

"The company’s name is inspired from what happens after there is a fire in the forest," José Tomás Lobo explained. "Though the whole land is black and filled with ashes, it is still fertile, and when the monkeys start going from tree-to-tree eating seeds, they drop many of the seeds on the ground, which become new growth."

Mono offers debit and credit services that can be used for transfers and payments, operating in cooperation with a banking institution from Colombia. The company has plans to expand throughout South America to countries like Mexico, Peru, Chile, and Brazil. The company remains on the cutting edge of financial services with its fast and efficient approach to banking.

Image Credit: Mono

Trend Themes

1. Tailored Banking Services - There is room for more fintech companies like Mono to provide tailored banking services to small businesses and startups, especially since traditional banks tend to have rigid processes.

2. Expansion of Fintech Industry in South America - The fintech industry in South America is ripe for growth and expansion, and companies like Mono have the potential to capture a significant market share as they move to more countries in the region.

3. Efficient Financial Services - Efficiency is an important factor in the financial services industry, and companies that can offer fast and efficient banking solutions, such as Mono, have a disruptive innovation opportunity to capture market share.

Industry Implications

1. Fintech - The fintech industry is rapidly growing and evolving, providing a lot of opportunities for disruptive innovation such as what Mono offers in providing banking services tailored to small businesses and startups.

2. Small Business Banking - As small businesses continue to grow in number, there is an opportunity for more fintech companies to provide banking services tailored to their unique needs and help bridge the gap in traditional banking services.

3. Startup Banking - Startups have specific banking needs that might not be efficiently met by traditional banks. This gives innovative fintech companies like Mono the opportunity to provide tailored banking services that meet the unique needs of startups.

2.2

Score

Popularity

Activity

Freshness